Introduction

XM was established in 2009 and currently has over 1.5 million traders in 196 countries. Rigorous institutions like CYSEC, ASIC, IFSC, and FCA regulates the XM group to make sure it is legitimate and legal.

The brokerage has over 1000+ financial instruments for trading with transparent fees and commissions. The speed of execution is pretty rapid, and traders can test it with a demo account. Register and try it out today!

Pros and Cons

PROS

CONS

Assets

1000+ financial instruments, along with six asset classes, are offered at XM. The asset classes are forex, stocks, commodities, precious metals, energies, and equity indices.

Forex

- 55+ Currency major, minor, and exotics pairs are available with tight spreads and no re-quotes. Leverage up to 1:888 based on your account type with no hidden charges levied.

- “Swap” function is also offered, which is paying or obtaining currency pairs’ interest rates difference after you enter a position automatically at 00:00 (GMT+2) via the XM terminal.

Stocks CFDs

- 1230+ Stock CFDs are offered by XM, which enables you to get instant access to the global equity market with no complicated procedures. You can use your position long and also short them based on the market movement.

- It is one of the best advantages of CFDs. You can directly approach the international market to Long and Short with transparent fees and commissions along with leverages. Plus, you will get a dividend yield by holding stocks!

- There are 19 countries’ international stock CFDs to trade.

Supported countries

US, UK, France, Germany, Netherlands, Spain, Switzerland, Belgium, Italy, Greece, Portugal, Sweden, Finland, Norway, Austria, Russia, Australia, Brazil, and Canada.

Commodities

- XM provides Commodities like Cocoa, Coffee, Corn, Sugar, Bean, Cotton, Copper, and Wheat as futures CFDs in XM. The maximum leverage is up to 1:50, with a 2% margin percentage.

- It means it is ideal for beginners to try with low deposits! The spreads are tight, and it enables you to Long and Short the position. Along with the forex market, the commodity is an excellent means for portfolio diversification and risk management.

CFDs for Indicies, Precious Metals and Energies

- In terms of Equity Indices CFDs, XM also offers Cash Indices CFDs like AUS200Cash, US100Cash, EU50Cash, and more. It is basically like an index of the fiat currency, which quite different from forex pairs.

- There are 10 Futures indices CFDs like EU50, FRA40, GER30, JP225, US500, and more. These are CFDs that you can trade based on the equity index.

- Gold, Silver, Platinum are available as Precious Metal CFDs.

- Offers Brent oil, WTI oil, and Natural gas as Energies CFDs.

International Stocks (Stocks Account ONLY)

- Lastly, there are 100 International Stocks from the US, UK, and Germany offered in XM via a Stocks Account, a different sort of account from other types. Amazon, Apple, Netflix, Google, and more stocks are available for you to trade them.

- The charges for all US shares are $0.04 commission per share, with a minimum of $1 commission per transaction.

- UK shares are 0.1% per commission transaction with a minimum of $9.

- German shares are 0.1% commission per transaction with a minimum of $5.

Spread & Commission

XM provides tight and low spreads as 0.6pips to the traders with determination. The Chief Dealer of XM quotes, ” We aim to get optimal prices from liquidity providers to offer the best bid and ask clients prices. We update the price three times per second to keep spreads tight.”

There are no hidden fees or commissions. The trading fees are already applied to the spread to trade 1000+ CFDs. Yet, for the shares (not CFDs), fees are levied per share depending on a corporation’s nationality.

Variable spreads are offered instead of fixed spreads. Fixed spreads tend to charge higher than the variable one, which traders can take advantage. Plus, XM also offers fractional pip pricing instead of 4-digit quoting prices; it offers 5th digit fraction, enabling traders to trade with tighter spread and accurate quoting!

Leverage

The extent of leverage you can utilise varies on the amount of equity in your account ( Equity = balance + credit). The leverage can scale from 1:1 to 1:888 maximum. You can also request XM brokerage to increase or decrease the leverage. The negative balance protection is applied to prevent your balance from going negative.

Remember, leverage is a short-term credit provided by the broker. It could let you acquire more financial gains but also significant losses. In the worst-case scenario, a stop-out may occur, which means losing all the funds you have a bet. Capital Management is necessary, and to bet a fraction of your fund makes your yielding curve much more stable based on Kelly’s formula.

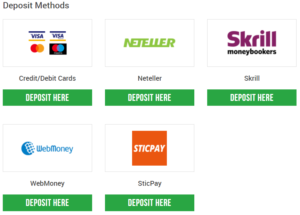

Deposits and withdrawals

Deposits:

You can USD Credit/Debit Cards, Neteller, Skrill, WebMoney, and SticPay as a means of depositing your fund. XM charges no deposit fee! Using credit/debit cards and electronic wallets let you deposit instantly right after the transfer.

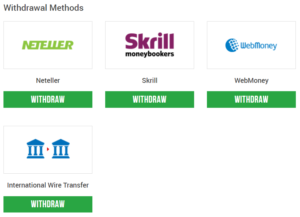

Withdrawals:

Neteller, Skrill, Webmoney, and International Wire Transfer are the options to withdraw your fund. Again, XM charges no withdrawal fee too! Instant withdrawals for electronic wallet and took two business days for bank transfer.

If you have another account of your XM brokerage, it also supports the internal transfer, eliminating the inconvenience of withdrawing and re-depositing your fund to an account!

Account Types

Levied on Spread EUR,GBP,USD, AUD,CHF, JPY, HUF,PLN,SGD, RUB,ZAR Standard Account Levied on Spread EUR,GBP,USD, AUD,CHF, JPY, HUF,PLN,SGD, RUB,ZAR Levied on Spread EUR,GBP,USD, AUD,SGD, ZAR US = $0.04 UK = 0.1% GER = 0.1% (per shares)

Fee

Minimum Deposit

Currency

Micro Account

$5

$5

XM Ultra Low

$50

Shares Account

$10,000

USD

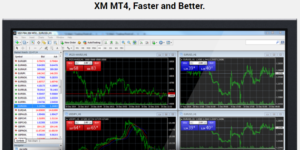

Trading Platforms

Metatrader4

MT4 is the industry standard trading platform that millions of traders trade daily. XM also offers MT4 as the trading platform with no requotes and no rejections. The broker offers up-to 1:888 leverage based on your account type.

Keynotes:

- Mac, Windows, iOS, and Android supported.

- 1000+ instruments are available.

- TIght spread – as low as 0.6 pips.

- Three types of charts are available (Candle, Bar, and Line Chart).

- Nine time-frames to monitor the market.

- 50+ technical indicators to analyse.

- Fully customisable interface.

Metatrader5

MT5 is an upgraded version of MT4 that was launched in 2010. It has more functionality compare to MT4, which empowers traders to trade with confidence. XM MT5 offers in addition to 1000 stocks that XM MT4 does not provide. Forex, commodities, precious metals and more are supported with no requotes. The maximum leverage you can use is up to 1:888.

Keynotes:

- Mac, Windows, iOS, and Android supported.

- 1000+ instruments are available.

- TIght spread – as low as 0.6 pips.

- 38+ technical indicators are implemented.

- 44+ analytical objects are available.

- 21 time-frames and an unlimited number of charts are offered.

- Multi-threaded strategy tester.

- Alerts to remind up-to-date market events.

- Economic calendar and email system.

Research&Education

XM offers various research tool to acquire an overview of the market with up-to-date news, economic calendar, podcast and more. All of the contents that are implemented in the Research section is very well-organised and provides in-depth insights to understand what is happening around the world.

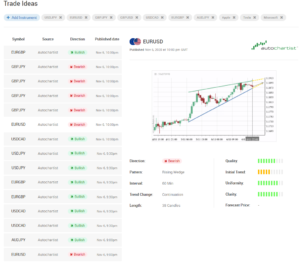

The ” Trade Ideas” seem to be very interesting as it offers lots of trading ideas upon 1000+ instruments which you could consider during your trading! These functions are available for the members-only, so you may need to register to utilise all these useful functions!

In terms of education, XM provides Economic calendar, XM live, Educational Videos, Forex Webinars, Platform Tutorials and Forex Seminars. It is mostly concentrated on videos instead of materials like e-book and PDF files. These videos may give you an overview of how to use the platform 100% along with the basics of trading.

Promotions

Currently, XM has lots of promotion going on.

- Acquire $30 for opening an account.

- 50% deposit bonus up to $500 and 20% deposit bonus up to $4500

- Raffle draw event with a 100% bonus, $5000 total in the prize.

- $35 per friends invited

- Free VPS service for EAs and fast order execution.

These promotions are perfectly designed for a new trader who wants to participate in the world of forex and CFD trading. A fantastic opportunity that you may not want to miss out!

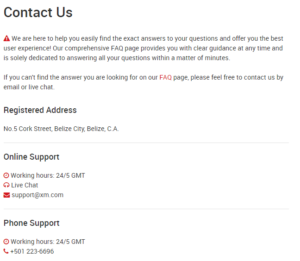

Customer Service

XM’s Customer Service was fast and friendly. You can use live chat, phone call and email to contact them. They are available 24/5, which means no support on the weekends. The answers to specific questions via live chat were well-replied and relevant. You can also ask anything related to trading financial instruments!

Regulation and Licensing

Cyprus Securities and Exchange Commission (CySEC) License Number: 120/10 International Financial Services Commission (IFSC) License Number: 000261/106 Financial Conduct Authority (FCA) License Number: 705428 Australian Securities and Investment Commission (AFSL) License Number: 443670 Dubai Financial Services Authority (DFSA) Reference Number: F003484

Legal Entity

Regulator

Trading Point of Financial Instruments Limited

XM Global Limited

Trading Point of Financial Instruments UK Limited

Trading Point of Financial Instruments Pty Ltd

Trading Point MENA Limited

Accepted Countries

Restricted Regions: XM Global Limited does not provide services for the residents of certain countries, such as the United States of America, Canada, Israel, and the Islamic Republic of Iran.

Conclusion

XM gave us an impression of where it is very client-orientated. Because it charges no deposit and withdrawal fees, low CFD fees, and numerous promotions going-on for the newcomers. It offers 1000+ instruments in 6 different asset classes with tight spread and fast order execution.

But, the forex trading fee is industry average and charges inactivity fee (if inactive for 90+days, $5 is charged per month). Plus, investor protection is applied to only EEA countries, which means clients from non-EEA has no protection when the company has an accident. The good thing is that even though the customer belongs to the non-EEA country, the funds are secured via segregated accounts.

Overall, XM offers what is necessary for traders. Minimise the fees and provide tools to aid their trading, There User Interface of the entire website might not be that fancy as others, but remain organised and easy to understand. It would be an adequate broker for new participants of the market with privileges to enjoy from the beginning.