Introduction

FXTM is a top-class forex and CFD broker founded in 2011. Rigorous institutions regulate it throughout the continents. The firm has been growing across Europe, Africa, and Asia. The broker provides tight spreads and fast speed of execution for traders, establishing reliable trading conditions. Hence, FXTM empowers traders with a wide range of education materials suitable for both beginners and advanced traders.

Pros and Cons

PRO

CON

Assets

- Forex Pairs (50+ pairs)

- Spot metals (Gold & Silver)

- CFDs on Commodities/ Indicies / Stocks

FXTM provides more than 250 instruments, including forex pairs, CFDs on indices, spot metal, and shares. They offer a good range of markets for traders to trade.

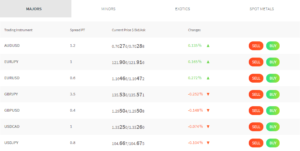

Spread & Commission

The commission rate that FXTM offers for Forex traders are comparatively low and an industry average for CFD traders. You can enjoy competitive spreads starting from 1.3 pips on the Standard MT4 trading account and 0.1 pips on the ECN MT4 and ECN MT5 trading accounts.

You will pay trading fees when you trade. These fees are spreads, commissions, and conversion fees. For standard accounts, spreads are higher but the commission-free. ECN accounts charges commission, but spreads are low. The formula for calculating the commission is

(Volume * Contract Size * Open Price) / 1,000,000 * Commission * 2.

Leverage

With FXTM, you will be able to trade with fixed or floating leverage. Leverage may potentially increase your profit but losses as well. Thus, the two major factors determine the level of leverage. The first is the regulatory requirement of a particular region. The second is the experience level of the trader.

Therefore, if you are willing to operate under a high leverage ratio up to 1:2000, you must open a specific account offered by the global brand. If you are dwelling in the UK or Europe(ESMA regulation), it restricts maximum leverage to the 1:30, including significant pairs like EURUSD, GBPUSD, and USDJPY.

Minor pairs to 1:20, Spot metals to 1:20, Indices to 1:5, Commodities to 1:10 (US Crude oil), and CDF US shares offer 1:5 leverage. Remember not to use leverage too much, which could result in a margin call of your position in a split second.

Deposits and Withdrawals

FXTM supports more than 40+ ways to deposit and withdraw the trader’s fund 24/7. For instant deposits, we recommend using Skrill, Neteller, and other credit cards for instant transactions with no fees to be paid. It is simple and easy to transfer your fund to FXTM with various options. The minimum required deposit is 10 USD, and it is free! But, in terms of withdrawal methods, the commission is added.

How to deposit?

You may have to choose the methods based on your region. FXTM is rapid in terms of processing the deposits. It usually takes 2 hours to arrive for you to start trading. The minimum required deposit is $/€/£ 10 for CENT ACCOUNT and $/€/£ 100 for STANDARD ACCOUNT.

Deposit Method

Fee Commission

Processing Time

Visa, Mastercard, Maestro

FREE

INSTANT

Skrill, Neteller

FREE

INSTANT

Crypto

FREE

24 HOURS

VLOAD, TC Pay, Alfa-Click, Web Money, Yandex, QIWI, Perfectmoney, Konnexone

FREE

INSTANT

Local Transfer of Turkish, South Arabian, African, Ghanan, Latin America, Dubai, Moroccan, Nigeria, Indonesia, Algerian, Afghani, Laos, Egypt, Bangladeshi, Iraq, Palestine

FREE

1-2 Business days

Online Banking of China, Vietnam, Thailand, Indonesia, Malaysia.

FREE

1-2 Business days

How to withdraw?

Usually, it takes two business days after you confirm the request to withdraw the fund from your trading account. Some of the methods require a withdrawal fee while others are free.

Deposit Method

Fee Commission

Processing Time

Visa, Mastercard, Maestro

2 EUR/ 3 USD/ 2 GBP

24 HOURS

Skrill, Neteller

FREE

24 HOURS

Crypto

1%

24-48 HOURS

VLOAD, TC Pay, Alfa-Click, Web Money, Yandex, QIWI, Perfectmoney, Konnexone

DEPENDS

24 HOURS

Local Transfer of Turkish, South Arabian, African, Ghanan, Latin America, Dubai, Moroccan, Nigeria, Indonesia, Algerian, Afghani, Laos, Egypt, Bangladeshi, Iraq, Palestine

DEPENDS

1-2 Business days

Online Banking of China, Vietnam, Thailand, Indonesia, Malaysia.

DEPENDS

1-2 Business days

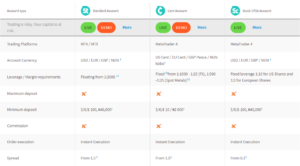

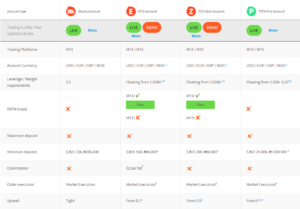

Account Types

There are two major categories of accounts that you can choose to register, Standard and ECN. Each sort of account has different options levied. Let’s take a look at the specific details of them.

Standard Account

- Standard Account provides leverage up to 1:2000.

- The minimum deposit is $/€/£ 100.

- Spread begins from 1.3.

- 59 pairs of forex.

- 5 pairs of spot metals.

- 14 pairs of spot CFDs.

- 4 pairs of cryptocurrencies.

Cent Account

- Cent Account provides leverage up to 1:1000.

- The minimum deposit is $/€/£ 10.

- Spread begins from 1.5.

- 25 pairs of forex.

- 2 pairs of spot metals.

Stock CFDs Account

- Stock CFDs Account provides leverage up to 1:10

- The minimum deposit is $/€/£ 100

- Spread begins from 0.1

- 120+ pairs of US shares

- 40+ European shares

Stocks Account

- Only for Exinity Limited Customers

- Stocks Account provides no leverage.

- The minimum deposit is $/€/£ 100.

- Spread depending on the market situation but remains tight.

- US stocks are available for trading.

ECN Account

- ECN Account provides leverage up to 1:2000.

- The minimum deposit is $/€/£ 500.

- Spread begins from 0.1.

- 48 pairs of forex.

- 3 pairs of spot metals.

- 14 pairs of spot CFDs.

ECN Zero Account

- ECN Zero Account provides leverage up to 1:2000.

- The minimum deposit is $/€/£ 200.

- Spread begins from 1.5.

- 48 pairs of forex.

- 3 pairs of spot metals.

- 14 pairs of spot CFDs.

FXTM Pro Account

- ECN Zero Account provides leverage up to 1:200.

- The minimum deposit is $/€/£ 25,000.

- Spread begins from 0.

- 43 pairs of forex.

- 2pairs of spot metals.

How to open Accounts?

1.Visit the FXTM home page and click OPEN ACCOUNT.

2.Enter your Name, Country, Phone number, Email, and Password.

3.After verification, the registration is complete.

4.After log-in, upload your document to verify your profile.

5.Deposit your fund and start trading!

Trading Platform

The trading platform is online software that helps investors to access Forex and other financial markets. You can utilize a wide range of tools, indicators with a different time frame to monitor and analyze the market. MetaQuotes software launched MT in 2005, and it soon became the go-to industry trading platform.

MT4

MetaTrader 4 is a stand-alone online trading platform developed by MetaQuotes Software. It provides access to a range of markets and hundreds of different financial instruments, and you will have all the tools you need to manage your trades and analyze the markets while it is free to everyone. This trading platform enables you to access more than 30 technical indicators, which may help you identify market trends and signals for entry and exit points.

Keynotes:

- Easy to read charts.

- Real-time monitoring of the market.

- Provides 30+ technical indicators.

- Nine different time-frames to choose from.

- Determine entry and exit points based on signals.

- Multi-device functionality and trustworthy security system.

MT5

MetaTrader 5 is the newest and most advanced online trading platform in the industry, offering from MetaQuotes. It includes a multi-threaded strategy tester, fund transfer between accounts, and alerts to remind you of the latest events. Combined with innovative services like FXTM’s Pivot Point tool and FXTM Invest, it ensures traders to have all the resources needed to trade with confidence. Hence, Its diverse functionality, fundamental and technical analysis tools, copy trading, and automated trading equip you with the best tools and instruments available. MetaTrader 5 is also entirely free for download.

Keynotes:

- 44+ analytical objects with an unlimited number of charts.

- 38+ technical indicators are implemented.

- Economic calendar and email system.

- Multi-threaded strategy tester.

- Fund transfer process between accounts.

- Alerts to remind up-to-date market events.

- Embedded MQL5 community for traders to chat.

FXTM utilizes the industry’s best third-party software, MT4, and MT5 as the trading platform. Both of them provide Web Trading platforms as well as installed directly to PC or any other devices. These trading platforms are easy to use with a range of tools. There are lots of educational materials to learn about this platform. Meanwhile, automated trading and back-testing functions are also available. So for those seeking quantitative investing or system trading, this is the right tool for you.

Copy Trading

FXTM has a copy trading function, which is also named FXTM Invest. With this fabulous service, you can choose which traders you want to copy based on their performance. The system will give you the authority to fully control your own money, and you only need to pay the fee to the strategy manager when there are profits.

When you are choosing a strategy manager, we recommend you not only consider the profit percentage over some time but also MDD (Maximum Drawdown). MDD means a percentage of losses from peak to bottom of a yielding curve. Plus, check the level of leverage, profit factor, winning rate of the strategy manager, and the percentage of the fee that has to be shared.

Trading may give you financial benefits but also cause a loss of your precious fund. Copy-trading does not guarantee profits. Thus, choosing the right manager is the key to success.

How to use FXTM Invest?

1.Pick a Strategy Manager based on your preferences.

2.Make a deposit, as little as $100.

3.Automatically copy the strategy.

4.Cash in when your manager earns a profit.

5.Share a portion of profit with the manager.

Education

FXTM provides numerous educational materials such as E-books, Seminars, Webinars, and more. Users can choose a range of sources to learn about the following topics. Going through these sources of materials is very useful for beginners who have just started learning how to trade.

- E-books

- Forex trading seminars

- Forex trading webinars

- Forex glossary

- What is Forex?

- Beginners guide to Forex trading

- Forex trading strategies

- Educational videos

- Articles

- Periodic table

Their materials for education covers insightful topics and useful for traders to discover new strategies. The E-book covers technical analysis, cryptocurrency, and habits for the traders to gain success.

They regularly open up the seminar with several experts working in the finance background for a long time. It may further enhance the traders’ information and knowledge to trade and survive in the market,

The glossary covers hundreds of vocabulary related to trading. We are confident that you can find any vocabularies you are curious about in terms of trading.

“What is Forex” section is a great place to learn about Forex trading basics. Moreover, they also provide Forex trading hours, which reminds us which pairs of Forex will open up the market.

FXTM well-prepared resources for people to learn about the market and trade those assets listed on the market. Books, glossary, Videos, Webinars, more are ready for you to learn about them!

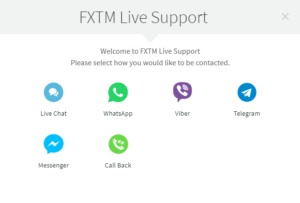

Customer Service

FXTM is a very client-oriented and a competent customer service that is available through emails, online chat well as phone calls instantly. Feel free to contact them anytime, anywhere you want related to the platform!

The firm has a good reputation from clients for supporting a great range of 18 languages for traders worldwide. They are fond of the traders, and you can ask questions about trading. There are centres in Asia, Africa, Europe, and more, which implies that FXTM cares about users worldwide.

Regulation and Licensing

Several jurisdictions regulate FXTM.

Cyprus Securities and Exchange Commission (CSEC) License Number: 185/12 Financial Sector Conduct Authority (FSCA) FSP No. 46614. Financial Conduct Authority(FCA) License Number: 600475 Financial Conduct Authority(FCA) License Number: 777911. Financial Services Commission (FSC) License Number: C113012295.

Legal Entity

Regulators

ForexTime Limited

ForexTime UK Limited

Exinity Limited

Accepted Countries

Regional restrictions: FXTM brand does not provide services to the USA, Mauritius, Japan, Canada, Haiti, Suriname, the Democratic Republic of Korea, Puerto Rico, and Cyprus’s occupied area.

Conclusion

FXTM provides reliable trading conditions with a tight spread. The trading fees for forex trading are highly competitive in the industry. It would give an edge for traders to succeed in trading.

Making an account is simple and easy, 100% digital. The deposit fee is free but charges commissions to withdraw. It also charges Inactivity fees if you don’t trade over 6 months.

Overall, FXTM has spectacular educational materials and is a go-to Forex broker for beginners who seek to learn the basics of trading. Provides Demo accounts, and the minimum deposit is as low as $/€/£ 10. We believe FXTM is the best place to start your trading journey.