What is Automated Trading?

Automated trading is also named system trading or expert advisors(EAs) that enable a trader to enter and exit positions with pre-setted rules automatically. A trader can concentrate on research and backtest strategies while the system does the trading.

As technology evolves, the barrier to enter the world of system trading is getting easier. Because of the internet, a lot of strategies are open and has all the necessary information to build your own system.

Even though you do not know to program, you can still do automated trading via copy trading or purchase an EA. Automated trading is just a tool that helps you to buy and sell as you wanted. The most important thing is the strategy and the inputs you are using.

Therefore, if you are aware of trading strategies, you can request a freelancer programmer to develop a trading system on behalf of you. Before you start trading with the system, you have to backtest the strategy and start with a demo account. Once, it has proven profitable with low MDD(Maximum Drawdown), you can start with a small amount of capital and increase gradually.

What are the Strengths and Weaknesses of Using Automated Trading?

Strengths

1.Consistency

Trading system trades repeatedly based on strategy and inputs. It does not complain and much more cost-efficient than hiring a person. This will reduce the probability of making mistakes and enhance performance in the long-term.

2.Backtest

Backtest enables you to see how the strategy performed in the past. It provides statistics such as profit rate, MDD, hit ratio, sharp ratio and more to clearly see whether the strategy is working or not. Plus, it also allows you to change the variables to optimise the system.

3.Emotion-free

The trading system is a batch of code which works base on the commands in computer language. It does not have emotion like a human being and does not feel pain when you are losing trades. Plus, It can let you get rid of the pain to watch the market that operates 24/7.

4.Speed

The speed of executing trades can be as fast as milliseconds, depending on which strategy and algorithm you are using. In terms of HFT(High-Frequency Trading), it can be done only by the trading system. Since the speed of clicking the buy button would be slower than the HFT strategy.

5.Diversity

There are more than 1000+ financial instruments you can trade including forex and CFDs. As studies have found, 1 to 3 instruments are what humans can efficiently monitor simultaneously. With the trading system, it can trade various assets and instruments when the requirements to enter or exit position is fulfilled. It is able to handle more opportunity and diversify risks by trading multiple instruments.

Weaknesses

1.Need to update

The strategy that the system is utilising might not last forever. The fundamentals and patterns of the market change over time repeatedly. Therefore, a consistent effort to enhance and optimising the algorithm is necessary. Maintaining a system actually requires lots of effort.

2.Observing

People might think system trading is ‘sit-back and watch’ stuff. In reality, an algorithmic trader monitors and observe the market consistently to improve the algorithm and get new ideas to develop a new system. Diversifying among the algorithms is essential for risk management.

3.System error

There are many variables that can cause an error. For example:

- If the server of the VPS goes off, no trades will be placed even though there is a signal to enter or exit.

- Price data of the broker might not be accurate instantly, resulting in a loss in trades.

- The code within the system clashes and give a wrong signal or none.

Therefore, building a system from scratch is very difficult to even for the algorithmic trader. You have to know not only to develop a system, but there are also several other factors to be aware of.

4.Over-Optimisation

Backtesting is done by past data. The statistics imply that since the strategy performed well in the past, there is a high ‘probability’ that it will perform well in the future as well.

Often times, people backtest and change the variables too much to get ideal results like high profit and low MDD. This can lead to over-optimisation and might not perform well in forward trading. So, it is one of the most important things to consider when you are optimising a system.

| PROS | CONS |

|

|

How Can We Get Started?

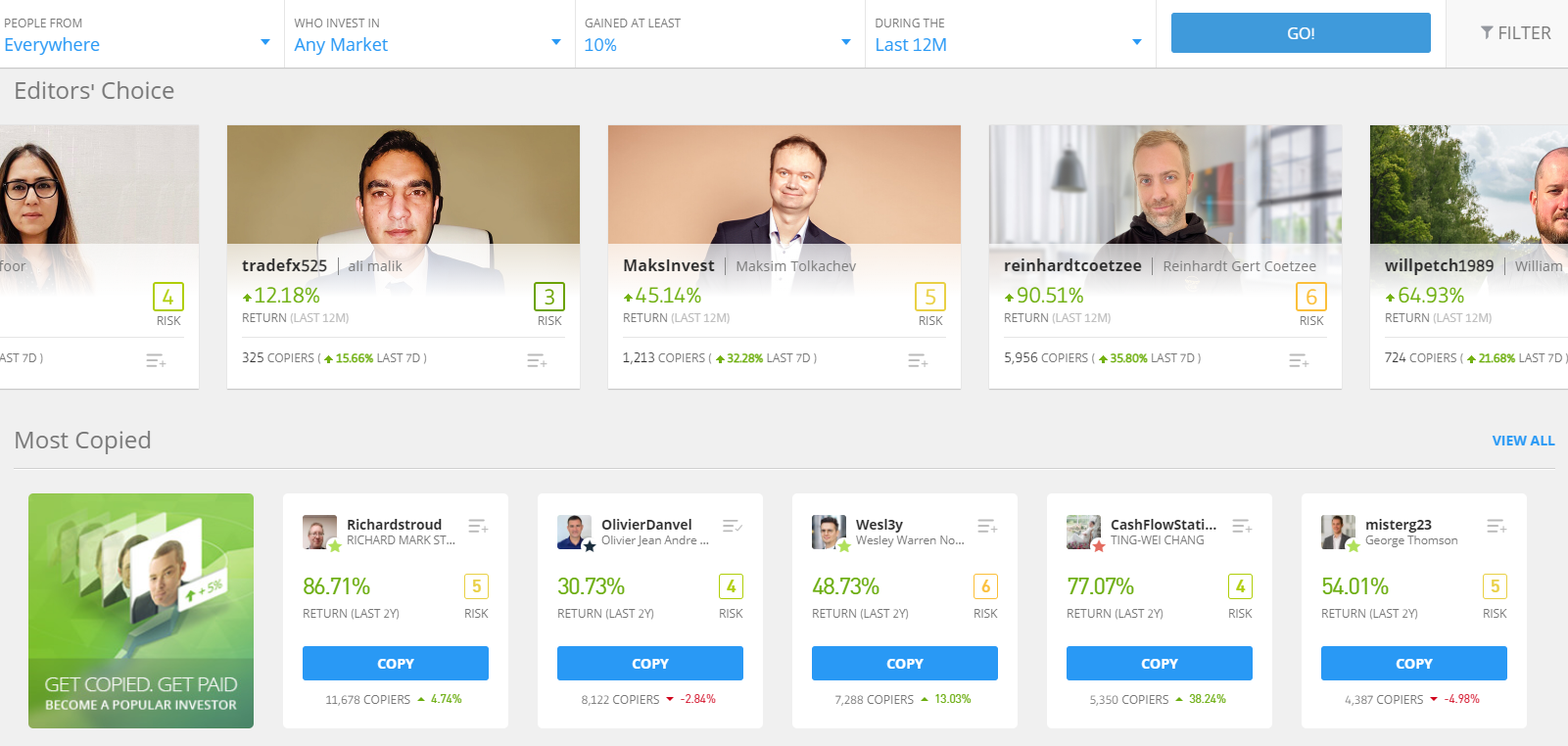

1. Copy-Trading

Copy trading is a form of social trading which you can follow the trader’s strategy with a few clicks. eToro and Zulutrade are famous platforms for copy trading. They handle stocks, forex, CFDs and crypto which endows a wide range of options and reveals the performance of their strategy transparently. This is the simplest way to get started with automated trading!

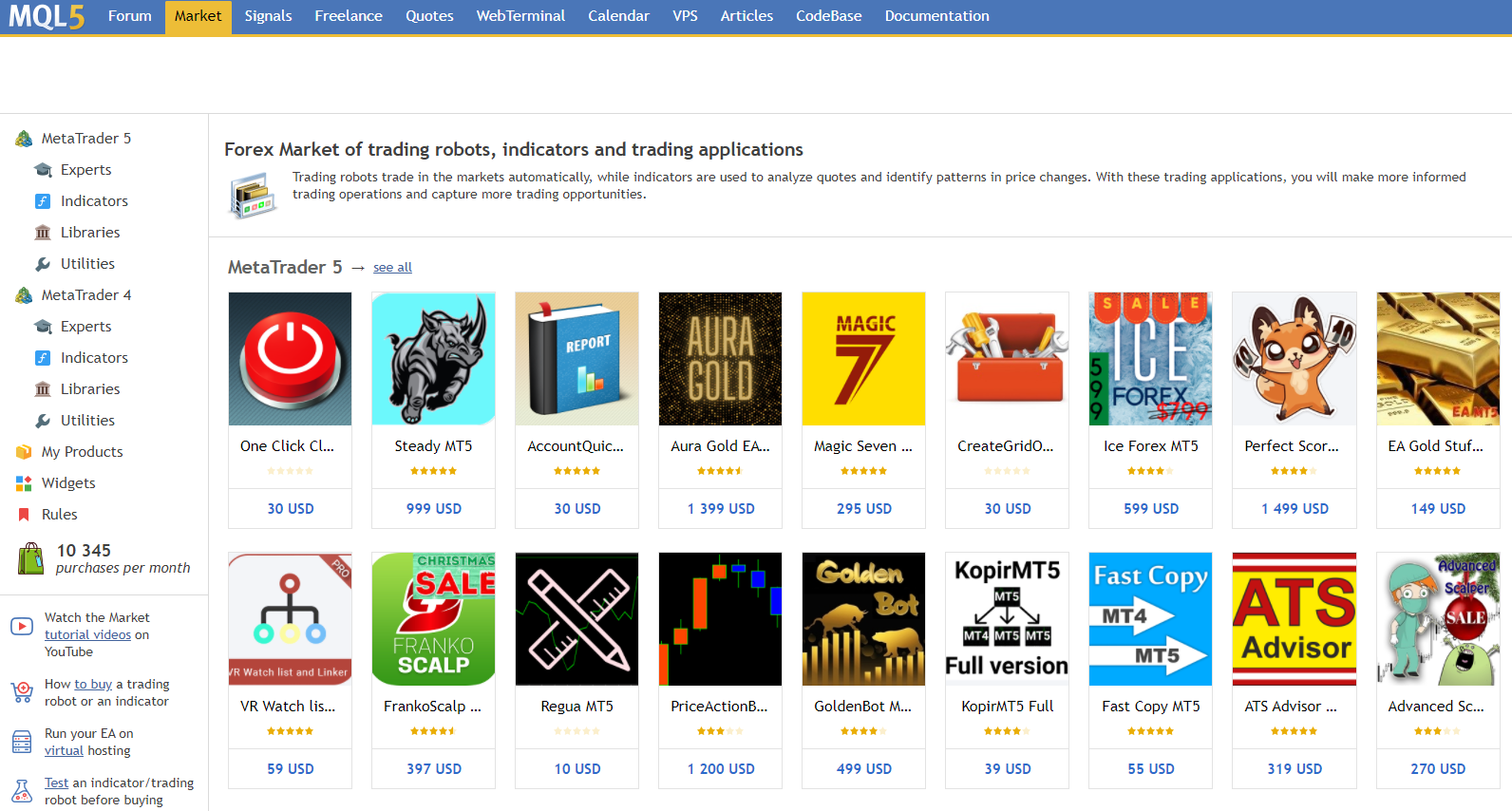

2. Find a Trading Software

Metatrader has a market place where algorithmic traders sell their own EA with an adequate price. All the statistics including trading history, performance and more are available for everyone. Using an EA in MQL4/5 enables you to start automated trading within the MetaTrader trading platform.

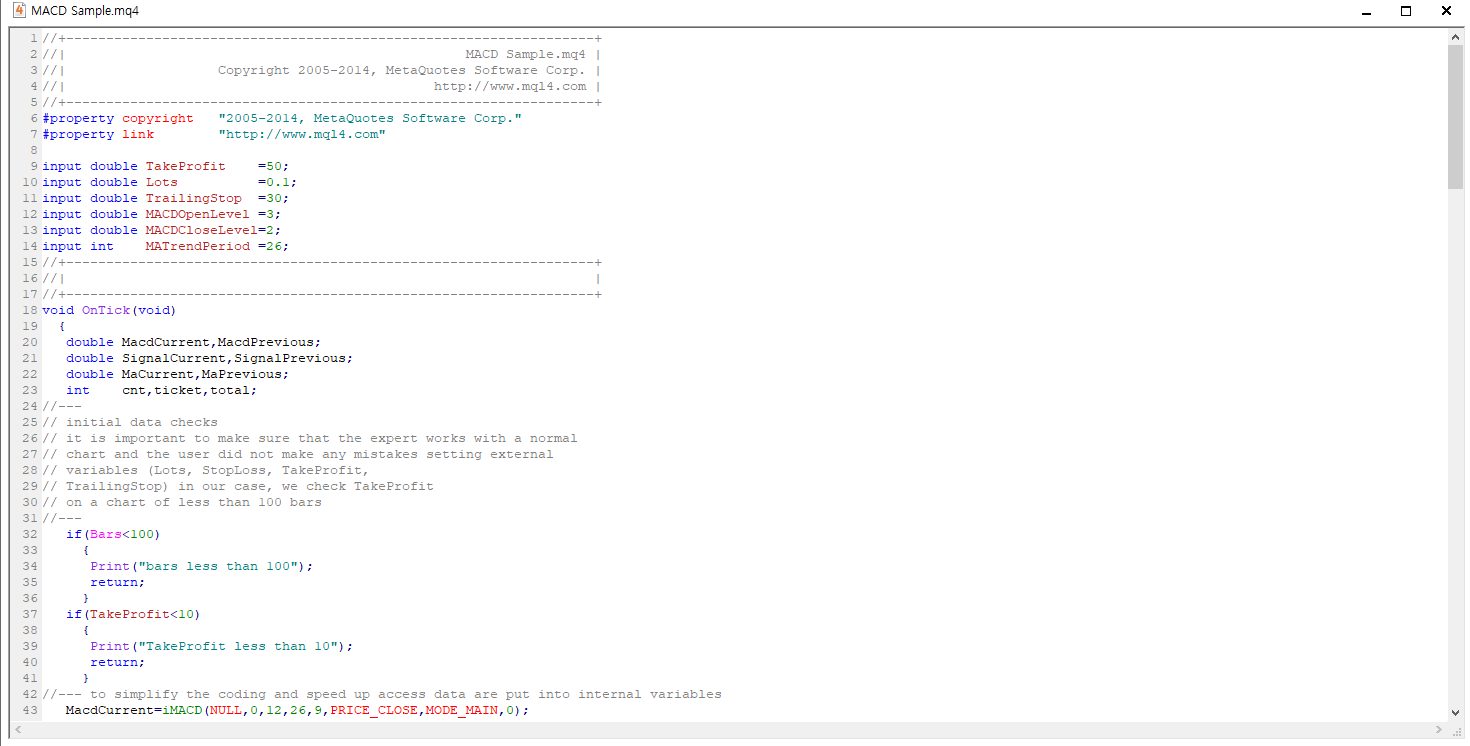

3.Develop on Your Own

If you are a developer and studied about trading, it would be great to develop your own system. The advantage of developing your own system is that, you know exactly how it works and the logic behind it. Therefore, the variables and inputs can be altered whenever you need to update it.

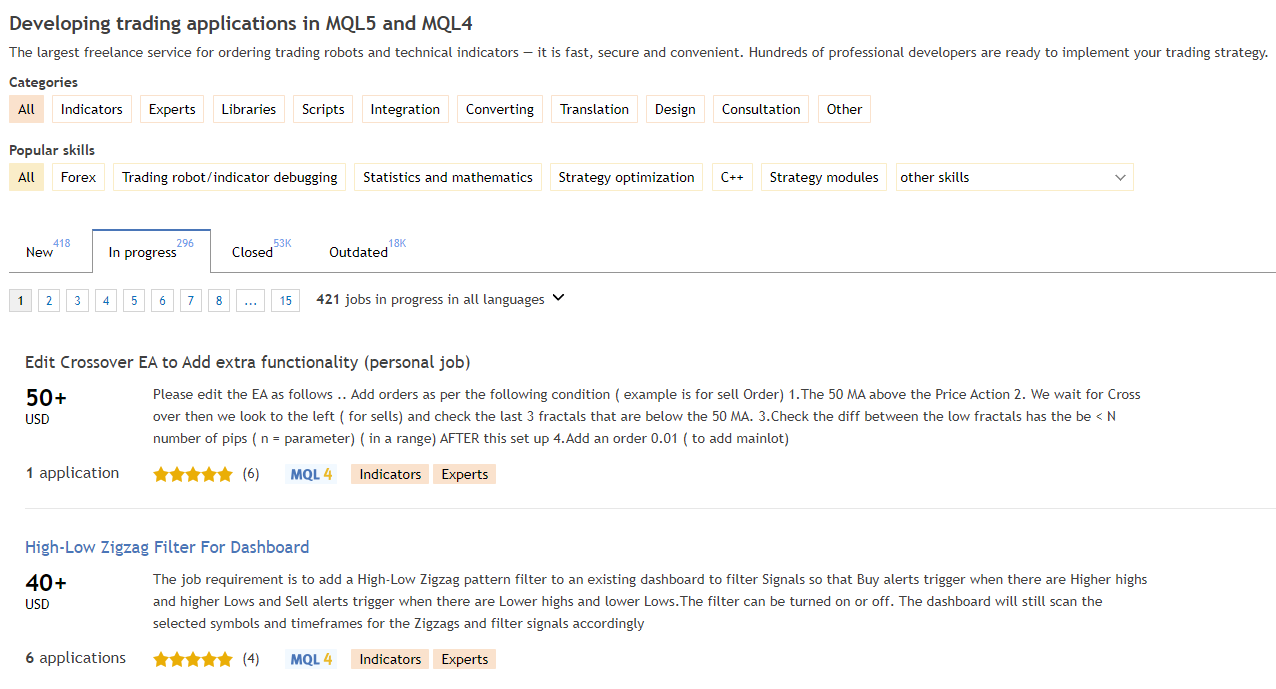

4.Hire a Programmer

If you have your own strategy, you can hire a freelancer who can develop an automated system for you. After the development, please backtest the strategy. After the testing, you can start with a small amount of fund or demo account. When it performs good for a certain period of time, you can put your a larger sum of capital.

Conclusion

The most important thing in automated trading is the strategy. The trading system is basically repeating the same process base on the variables and inputs inserted. Thus, whether it is manual trading or system trading, a proper strategy is necessary.

The good news is that even though you do not know too much about trading or developing, you can also use copy-trading service or purchase an EA on the marketplace. These will give you an idea upon how traders think and trade. It is a good source to benchmark and to start a trading journey.

Frequently Asked Questions

1. Can I trust the traders who are selling an EA?

The traders who are selling the EA might not reveal the code. This is also called black-box signal, which we do not really know the exact logic or inputs it is using. We would not say all the traders are fraud, but asking questions directly to the seller and check on the past performance as well as reviews may help to determine whether the system is reliable or not.

2. How much money will it cost to build a system?

Basically, you need a laptop and internet to begin. If you know how to develop a system, it will cost time to make one. If you do not know how to develop, it will cost the $30~50 for copy trading and $300+ for purchasing an EA. For hiring a freelancer, it may vary among the level of expertise and the strategy you are requesting.

3. Where can I learn about automated trading?

For retail investors, we would recommend you can begin by reading all kinds of books related to quantitative and technical analysis. Then get a strategy that works in the market you want to trade. Go deep-dive into 1~3 strategies that suits you and be an expert on them. Then learn how to code or request a freelancer to develop a system. It is much more flexible if you have your own system.