Introduction

FxPro has 15+ years of experience as a brokerage receiving 70+ global awards. That means they have got one award per quarter ever since the establishment! The brokerage has executed more than 400 million orders while serving 1.5 million clients over 173 counties. The broker lists in Tier 1 Capital and has more than 200 employees across its four offices—regulatory licenses in the UK, Cyprus, South Africa, and the Bahamas.

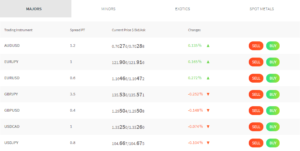

There are 260+ instruments in 6 asset classes for traders to trade! The spread is low for the forex traders, and the execution speed is as fast as 11.06 milliseconds. Throughout operating the platform, their technology can execute 7000 orders per second. Due to their location of the data centre, the latency is super low as well. They have provided reliable conditions for traders to trade with confidence.

Pros and Cons

There are 260+ instruments, including CFDs on Forex, Stocks, Futures, Spot Indices, Metals, and Energies. You can trade on six different asset classes with deep liquidity, rapid order execution, and tight spreads!

PRO

CON

Assets

INSTRUMENTS

FEATURES

Forex

Futures

Indices

Stocks

Spot Metals

Spot Energies

Spread & Commission

FxPro offers competitive floating spreads to all the instruments. The commission varies on the type of account you open. Let’s see the difference in fees charged among the accounts.

On MT4 and MT5 account, FxPro charges the spread on any instruments you trade. There is no commission to be paid. FxPro levied a small mark-up upon the spreads.

On the cTrader account, the spreads are much lower, starting from 0. Yet, it charges a $45 fee per 1 million USD traded upon opening and closing positions, which is reasonable.

On MT4 fixed spread, the net offers fixed spreads on the seven significant forex pairs.

Leverage

FxPro offers a dynamic forex leverage model that adapts automatically based on clients trading positions via trading platforms like MT4, MT5, and cTrader. If you open a position on EURUSD with 100 lots and USDJPY later on, the margin requirement will not be affected by the previous position.

Financial Instruments

Maximum Leverage

(Non-UK)Maximum Leverage

(UK)

Forex

1:500

1:30

Gold

1:200

1:20

Silver

1:200

1:10

Platinum

1:50

1:10

Spot Indices Major

1:500 (cTrader 1:50)

1:20

Spot Indices Minor

1:100 (cTrader 1:50)

1:10

Future Indices Major

1:50

1:20

Future Indices Minor

1:50

1:10

Energy Spot

1:100

1:10

Energy Futures

1:100

1:10

Commodity Futures

1:50

1:10

Shares

1:25

1:5

Cryptos

1:20

1:2

Deposits and withdrawals

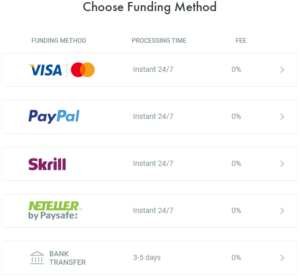

The minimum required deposit is 100 USD, which is adequate for getting started. Eight base currencies are available for you to choose from. The currencies are USD, EUR, GBP, CHF, PLN, AUD, JPY, and ZAR. FxPro charges no deposit fees, and you can use several ways to deposit your fund. Plus, it charges no withdrawal fees except for a fee to refund your PayPal account more than six months after the initial funding.

Deposit Method

Fee Commission

Processing Time

Visa, Mastercard

FREE

INSTANT

PayPal, Skrill, Neteller

FREE

INSTANT

Bank Transfer

FREE

3-5 DAYS

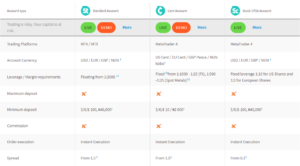

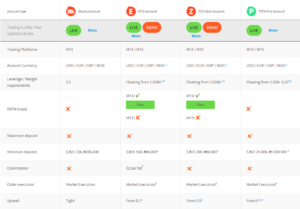

Account Types

FxPro MT Instant

- MetaTrader 4 Desktop, Web trader, iOS, and Android mobile apps supported.

- Forex, Futures, Stocks, Indices, Energies, and Metals are available.

- MT4 fixed spreads’ applies only to 7 significant pairs.

- The trading fee levied on the spread only (0 Commission).

- Instant Execution based on the price on the screen.

FxPro MT4

- MetaTrader 4 Desktop, Web trader, iOS, and Android mobile apps supported.

- Forex, Futures, Stocks, Indices, Energies, and Metals are available.

- The trading fee levied on the spread only (0 Commission).

- Market Execution based on VWAP (volume-weighted average price)

FxPro MT5

- MetaTrader 5 Desktop, Web trader, iOS, and Android mobile apps supported.

- Forex, Futures, Indices, Energies, and Metals are available (No Stocks).

- The trading fee levied on the spread only (0 Commission).

- Market Execution based on VWAP (volume-weighted average price)

FxPro cTrader

- cTrader Desktop, Web trader, iOS, and Android mobile apps supported.

- Forex, Metal, Indices, and Energies are available (No Stocks and Futures).

- Forex and Metal: $45 per 1 million USD traded.

- Indices and Energies: levied on the spread only (0 Commission).

- Market Execution based on VWAP (volume-weighted average price)

FxPro Edge

- FxPro Edge web, FxPro iOS, and Android mobile apps, and MT4 platform range supported.

- Forex, Futures, Stocks, Indices, Energies, and Metals are available.

- The trading fee levied on the spread only (0 Commission).

- Market Execution based on VWAP (volume-weighted average price)

Trading Platforms

FxPro Edge

MT4

MT5

cTrader

EA Trading

NO

YES

YES

YES

Chart Trading

YES

YES

YES

YES

One-Click Trading

YES

YES

YES

YES

Trailing Stop

NO

YES

YES

YES

Chart Time Frames

15

9

21

26+

Languages

1

37

49

22

Coding Languages

N/A

MQL4

MQL5

C#

FxPro Edge

FxPro Edge is a newly launched trading platform specialized for FxPro brokerage. It offers convenient and easy-to-use functions in terms of charting and technical indicators. The user interface is impressive and was super fast and easy to sign up. Interactive economic calendar and volatility push notifications are also integrated for traders’ convenience. It is an all-in-solution allowing traders to manage accounts, funds, and positions. Yet, it only supports one language (English), no trailing stop function, and does not support EA.

Keynotes:

- Mac, Windows, iOS, and Android supported.

- 6 types of charts are available.

- 15 time-frames to monitor the market.

- 50+ technical indicators to analyze.

- Fully customizable interface.

- Does not have an EA (Expert Advisor) function.

MetaTrader4

MetaTrader 4 is an industry-standard trading platform that most traders use to trade. You can customize various analytics market news, economic calendar and share trading ideas among traders. FxPro offers instant and market execution for MT4 accounts. Here, all the orders are executed with No Dealing Desk Intervention, which means the system completes trades within milliseconds. MetaEditor is a tool implemented in MT4, which allows you to build, back-test, and set up a fully automated trading bot via Expert Advisors (EA) based on a combination of technical indicators of your preferences.

Keynotes:

- Mac, Windows, iOS, and Android supported.

- 3 types of charts are available (Candle, Bar, and Line Chart).

- 9 time-frames to monitor the market.

- 50+ technical indicators to analyze.

- Fully customizable interface.

- MetaEditor for EA is ready for you.

MetaTrader5

MetaTrader 5 is the upgraded version of MetaTrader 4, which offers additional trading features to trade futures and stocks. The user interface might look assemble, but more functions are implemented for traders. The greatest thing about MT5 is that their environment for developing EAs is much more comfortable than MT4. The Drag and Drop block system enabled users who do not understand MQL5 language to create an automated trading bot. FxPro provides a free demo account. It worth a trial!

Keynotes:

- Mac, Windows, iOS, and Android supported.

- 38+ technical indicators are implemented.

- 44+ analytical objects are available.

- 21 time-frames and an unlimited number of charts are offered.

- Multi-threaded strategy tester.

- Alerts to remind up-to-date market events.

- Economic calendar and email system.

- They have embedded the MQL5 community for traders to chat.

- Allows both hedging and netting.

cTrader

cTrader is a brand-new trading platform that was established in 2010 by Spotware. It offers complete solutions for traders packed up with various features to enhance every aspect of your investment. It provides excellent indicators, advanced order types, fast entry, and execution. The User Interface is stunningly impressive and easy to understand the components.

cTrader also offers copy training, algorithmic trading solution, Open API, and FIX API. Together it is tuned for those people who are interested in system trading. If you don’t know how to make one, choose one to copy with a simple click!

- Mac, Windows, iOS, and Android supported.

- 9 charts are implemented ( Candle, Bar, OHLC, Line, Heikin, Dots, Renko, Range, and Tick chart).

- Over 70+ indicators are pre-installed for you!

- Custom indicators built-in cTrader Automate from thousands of developers.

- 8 different formats to set-up chart view based on your trading style.

- Easy to create up to 50 templates with a variety of strategies and time-frames.

Education

FxPro has educational materials for beginners as well as for advanced traders. There are lots of videos that you can go through to learn the basics of CFD trading from A-Z. Their education materials are in a format of cards consisting of Information and contents that are well-organized and easy to read with an awesome User Interface.

Contents are consist of :

- Basics – Good start for newbies

- Fundamental analysis – Tips for Beginners

- Technical analysis – Advanced Knowledge

- Psychology – Section to level up your trading

- Fundamental analysis 2.0 – Advanced Knowledge 2

- Trading tests – self-check online

- Video Tutorials – For Beginners and Advanced

Their education materials cover several different aspects, yet it tends to lack more insights, and the depth of knowledge might not be the level that you might have expected. Other than the materials on their website, we were impressed by the number of videos posted on YouTube. The number of subscribers is around 25,000+, with 235 videos are available for you to go through.

News and Analysis

There are news and analysis sections within the FxPro website, which may help you to provide up-to-date information occurring in the market worldwide.

These analytics are as following :

- Economic Calendar – World major data publications.

- Earnings Calendar – Information for the stockholders.

- Market Holidays – Days-off on world exchanges.

- FxPro Market News – Sharp analytics for active traders.

- Technical Analysis by Trading Central – Trading signals for all FxPro clients.

FxPro offers all of these functions to every user! Contents are well-organized and easy to read. Take consideration of these analytics would let you gather juicy information to aid your trading journey!

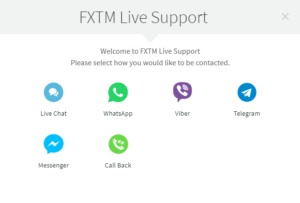

Customer Service

Their response was fast, friendly, and provides relevant answers to the questions. Their customer service is 24/5, which means you can’t get support during the weekends. The number of languages for assisting is more than 25+ languages, and you can contact them via live chat, email, and phone call.

Languages available

English, Chinese, Arabic, Bulgarian, Croatian, Czech, Danish, Estonian, Finnish, French, German, Hungarian, Indonesian, Italian, Japanese, Korean, Lithuanian, Malaysian, Norwegian, Polish, Portuguese, Romanian, Russian, Spanish, Swedish, Taiwanese, Thai, and Vietnamese.

Safety

Negative Balance Protection is offered to guarantee customers not to go into debt due to a margin call as part of the Client Agreement, subject to the Order Execution Policy.

FxPro UK Limited clients are eligible for compensation under the Financial Services Compensation Scheme (FSCS)*. Clients of FxPro Financial Services Limited are protected by the Investor Compensation Fund (ICF)

FxPro takes the safety of client funds very seriously. For this reason, all client funds are fully segregated from the company’s funds and kept in separate bank accounts in global banking institutions, including Barclays and Royal Bank of Scotland.

Regulation and Licensing

FxPro group operates three legal entities, each regulated by the relevant local authority in that jurisdiction. They have main offices in the UK, Cyprus, and Bahamas.

Cyprus Securities and Exchange Commission(CSEC) registration no. 509956 Financial Sector Conduct Authority(FSCA) authorization no. 45052

Legal Entity

Regulator

FxPro UK limited

Financial Conduct Authority (FCA)

FxPro Global Markets

Securities Commission of The Bahamas (SCB)

FxPro Group Limited

Financial Conduct Authority (FCA) registration no. 509956

FxPro Financial Services Ltd

Conclusion

FxPro offers 6 different asset classes as trading instruments, giving traders more freedom of choice. Implementing No Dealing Desk Intervention allowed traders to execute orders lightning-fast. No deposit and withdrawal fee is impressive. Meanwhile, cTrader, a brand-new trading platform, is also supported by traders!

Yet, FxPro offers much less number of stock CFDs compared to other brokers. Educational materials on the website lack in-depth knowledge. Lastly, their trading platform, FxPro Edge, only supports one language with no EA supported.

Overall, FxPro is a safe and well-known brokerage received 70+ international awards globally. For those who seek to trade different sorts of asset classes with a rapid trading execution speed, it is just the right one for you!