What is Forex?

Forex is the global foreign exchange market that enables you to exchange a currency to one another. Each currency represents a nation’s economy.

When you go to a currency exchange booth at the airport, you can see an electronic display screen with different exchange rates for various currencies.

The exchange rate is the comparative price of two currencies from two other countries. Exchanging your local currency to foreign currency is also a form of forex trading!

The foreign exchange market is a substantial financial market in the world. It is a global and decentralised market available 24hours a day, 5 days a week.

Since it is an OTC(over-the-counter) market, the data for exact volume is not crystal clear. And yet, it is estimated to be 6.5~7.0 Trillion USD per day!

Banks and corporations generate most of the trading volume. The second-largest volume is from retail traders speculating currency pairs to gain profit in the future. And only a portion of currency transactions happens in the physical economy. Such as buying products online and exchanging local currency to one another for travelling.

Why Should We Trade Forex?

Foreign exchange market enables traders to bet their position base on the economic status of a country.

Therefore, trading forex implies you are trading the entire economy. It is a cutting-edge advantage compare to other financial instruments!

More advantages empower traders.

- Position Direction: In forex, you can both long and short your position. For example, when you buy the EUR/USD pair, you are longing EUR and shorting USD in one single trade simultaneously.

- Ease to Access: Since the market operates 24/5 across the globe, it is accessible at any time you desire during the day. It offers you the option to trade whenever you want.

- High Liquidity: Forex market is the MOST liquid financial market in the world. Therefore, you do not have to worry about losing a portion of profit due to slippage. The only thing to concern is the trading fee imposed by the brokers. Most brokers offer ZERO fees and levies the cost on the spread.

- Wide Variety: United Nation advocates that there are officially 180+ pairs of currency that are legal globally. The combination of available currency pairs is massive. And yet, there the most preferred and liquid currencies around the globe like USD, EUR, GBP and JPY.

- Leverage: The brokers borrow capital for traders to utilise margin and leverage. It endows the power for traders to maximise their profit with a smaller amount of fund.

PRO

CON

What to Trade in Forex?

Trading forex means you are trading money against another kind of money. There are three types of Forex currency: Major, Minor and Exotic.

Major currency pairs are most frequently and widely traded currencies that represent the world’s largest economy.

Major Currency Pairs

EURUSD

Euro/US Dollar

GBPUSD

British Pound/US Dollar

USDJPY

US Dollar/ Japanese Yen

USDCAD

US Dollar/ Canadian Dollar

AUDUSD

Australian Dollar/US Dollar

NZDUSD

New Zealand/US Dollar

USDCHF

US Dollar/ Swiss Franc

Minor currency pairs are those with no US dollar. It is named minor or crosses currency pairs.

Minor Currency Pairs

EURCHF

Euro/Swiss Franc

EURGBP

Euro/ British Pound

EURCAD

Euro/ Canadian Dollar

EURJPY

Euro/ Japanese Yen

GBPJPY

British Pound/ Japanese Yen

GBPAUD

British Pound/ Australian Dollar

GPBNZD

British Pound/ New Zealand Dollar

Exotic currency pairs are currency pairs with a combination of one major currency and a currency of an emerging country like Mexico, Vietnam, or Turkey.

Exotic Currency Pairs

EUR/TRY

Euro/Turkish Lira

GBP/ZAR

British Pound/ South African Rand

USD/HKD

US Dollar/Hong Kong Dollar

JPY/NOK

Japanese Yen/ Norwegian Krone

AUD/MXN

Australian Dollar/ Mexican Peso

NZD/SGD

New Zealand Dollar/ Singapore Dollar

When Can We Trade Forex?

The Forex market starts each day in Australia and ends in New York. Major forex centres are at Sydney, Hong Kong, Singapore, Tokyo, Frankfurt, Pairs, London and New York.

It opens at 10 PM GMT on Sunday and closes at 10 PM GMT on Friday. The reason why it is available 24 hours day is due to different time zones around the world.

It runs on a decentralised network of a computer at all hours of the day, and it is also an OTC(Over-The-Counter) market with no cleaning house like the stock market.

Who is Trading in the Forex Market?

Central Banks

Central Banks are the face of a nation’s government which plays a vital role in the forex market.

They are responsible for stabilising their country’s currency via trading their notes on the open market to maintain a similar value to other currencies or increase the competitiveness of that nation’s economy.

For example, depreciating the currency using a monetary policy, supplying more money to the public, it would deliberately make exports more competitive in the global market.

It is because of the depreciation(fall in value) of the local currency, which makes domestic products became cheaper to foreign countries.

Commercial and Investment Banks

Interbank market generates the most amount of volume. It means banks are trading currency with each other through their private networks which retail traders could not access. They place these trades for clients and speculative bets from their trading desks.

Multinational Corporations

Any corporations involved in importing and exporting their goods and services, they are compulsorily engaged in the forex market.

Revenues from abroad have to be converted to their local currency to pay the bills for hiring workers and operation facility as well as research and development.

Corporations also trade foreign exchange to hedge the risk of the volatility of the currency as it is directly related to their revenue.

Retail Traders

The trading volume by retail investors is tiny when we compare it to the giant banks and corporations.

But, demand and popularity are increasing, provoked more forex brokers to emerge. Retail investors trade currencies by considering technical analysis, fundamental analysis and sentimental analysis.

With cutting-edge trading platforms, there are lots of individual traders build-up their trading bots or called EA ( Expert Advisors) with consistent and stable profits.

Hence, copy-trading is also an easy and straightforward way to engage with system trading for beginners!

How to Trade Forex?

Step 1: Choose a Broker that is Regulated and Reliable.

- It is a MUST to pick the right broker.

- Unregulated brokers may manipulate the price and even trade against the clients.

- Please take into consideration our Methodology to pick a right forex broker.

Step 2: Choose an Account Type that is Suitable for You.

- Brokers offer several accounts types.

- Every account has different conditions in terms of minimum deposit, leverage, spread and financial instruments.

Step 3: Choose the Trading Platform that you Prefer.

- You can choose to trade on a mobile phone, tablet PC, laptop and desktop.

- Metatrader 4 and 5 are the industry standard trading platform that millions of traders trade every single day.

- There are also other trading platforms like cTrader.

- Some brokers had built there own in-house version of the trading platform.

Step 4: Open-up the Trading Platform and Start Trading.

- After logging into the trading platform, select a currency pair you seek to trade.

- You can approach the market using technical and fundamental analysis.

- Pick your position direction. A buy or sell.

- Execute your trade by placing orders!

How is Forex Traded?

Forex trading involves trading exchange rates of currency pairs. The one significant difference from forex to other financial instruments is that you are buying and selling a currency at the same time.

For example, let’s say the exchange rate of GBP/USD is £1: $1.3. You expect the value of the pound may increase to $1.5, so you decided to buy the GBP using USD. During this process, you have just sold USD and bought GBP in the meantime.

What are Different Methods to Trade Forex?

Retail Forex

- Retail forex market is the secondary OTC(over-the-counter) market that offers a way for retail traders to trade in the forex market.

- The forex brokers receive price data from LP(Liquidity Provider) and provide a platform for retail traders to trade on the displaying prices.

- You are trading a contract, not the currency itself.

- The transactions in retail forex are closed out via entering an equal but opposite trade with the forex broker. The name of this process is liquidating or offsetting.

Forex CFD

- CFD is the abbreviation of Contract for Difference which tracks the market price of an underlying asset. It is a derivative product that trades are allowed to speculate the price will rise or fall.

- Forex CFD is a contract to exchange the difference in the price of a currency pair from opening and closing a position.

- It enables traders to bet on both directions, both long and short positions.

Currency Futures

- It is a contract that shows the details of the price to be bought & sold at a specific date.

- It was established by CME(Chicago Mercantile Exchange) in 1972

- The futures contacts are regulated and transparent.

Currency Options

- An option gives the investors the right to buy or sell an asset at a determined price on the expiration date.

- People trade options on an exchange like ISE(International Securities Exchange) and CME(Chicago Mercantile Exchange).

- The options market lacks liquidity compare to the spot or futures market with a limited hour to trade.

Currency ETFs

- ETF (Exchange-Traded Fund) is a basket of assets that offers exposure to a market as a whole.

- Wide range of currencies is in one financial instrument which enables you to diversify your portfolio while managing the risk.

- The ETF market does not open 24 hours a day, 5days a week and requests for a trading fee and expense ratio(operating cost).

Spot Forex

- Spot Forex market is an OTC(over-the-counter) market that operates 24 hours a day.

- It is a rapid, liquid and a massive market with no centralised exchange.

- The participants of the Spot Forex market is called interbank, which includes financial institutions and corporations.

- It is a contract pledged to buy/sell a settled amount of currency at the current exchange rate.

- Spot forex is not where retail traders trade currencies.

What are Pip and Lot?

Pip

Pip is a unit of measurement for the change in value between a currency pair. Most pairs have four decimal places, and a pip is the last decimal place of a price quote.

Let’s say; the EUR/USD moves from 1.1210 to 1.1211, the 0.0001 USD rise is one pip.

Lot

A lot is a unit of measurement for the amount of currency you want to buy or sell—these are four significant sizes of a lot when it comes to forex trading.

- Standard Lot – 100,000 currency units.

- Mni Lot – 10,000 currency units.

- Micro Lot – 1,000 currency units.

- Nanno Lot – 100 currency units.

What is Bid/Ask Spread?

Bid – represents the highest price that somebody is willing to pay.

Ask – represents the lowest price that somebody is willing to pay.

The difference between the bid and ask is called Bid/Ask Spread.

What are Margin and Leverage?

Margin

Margin is the amount of money that a trader needs to put to open a trade. It enables traders to increase their position size and open leveraged trading positions with a small initial capital.

Margin requirement varies among your region and the forex brokers. If a broker offers a 2% margin, and you want to open a $100,000 position, $2,000 is required to open a position. The leverage is 50:1 for this trade, and the broker provides the leverage.

Leverage

Leverage is a large amount of money borrowed from the broker. It gives traders more control of an enormous amount of capital with the little initial fund. The level of leverage a trader can use depends on the margin requirements of the broker.

If a trader wants to open a $100,000 position with $5,000, the trader can open a position using 1:20 leverage offered by the broker.

Leverage can give the trader to maximise the profit but also the losses. Therefore risk management is a MUST to be successful in forex trading.

Where Can I Learn About Forex trading?

Forex Websites

- Today, several quality websites offer free and quality contents to learn about forex.

- Basics of technical analysis, fundamental analysis and terminologies are available.

- It provides free indicators and signals for us to go through and learn about them.

Books

- There are tonnes of books released related to forex trading every single year.

- We recommend you to go through the best-selling books to get started.

Forums

- Forums, community and chat rooms are a fabulous place to understand how others approach the market.

- Experienced traders share their ideas and generously offer quality advice as well as free trading systems to try.

Videos

- You can start the basics of forex trading from Youtube to understand the mechanism of the market. But, be careful with those fake gurus trying to sell their useless courses.

- Online course platforms like Udemy offers high-quality videos to learn in-depth knowledge.

Offline Courses

- You can look for offline courses around your region so that you can ask questions directly.

- The best way to learn is to find the right mentor who can instruct you. Again, be careful with fake gurus!

Types of Orders

Market Order

A market order is simply a buy and sell order at the current price. When you put buy or sell order in the trading platform, it would execute the trade instantly.

It is similar to one-click ordering where you can click once, and you can trade at the current price of specific currency pairs.

During this process, the final price executed depends on the market condition. If the volatility of the market is very severe, you might not be able to trade at the exact price you wanted. It is called slippage.

Limit Order

A limit order is a form of an order that you place the price you want to buy or sell. It enables you to trade at the specific exchange rate of a currency pair. Therefore, you can prevent slippage from occurring.

For example, EUR/USD is trading at the rate of 1.3421, and you want to buy if the price reaches 1.3420. But, the price when further up 1.3425. You can either choose to place a market order before it goes up further or sit and wait until it drops to the price you want to buy.

Stop Entry Order

Stop entry order is orders that are triggered when the exchange rate of a currency pair moves above or below a specific price you have set. When it goes above or below the price, stop orders are converted into market orders to execute at the best price. Buy-stop orders, sell-stop orders, stop-market and stop-limit, are the types of stop entry order.

Stop Loss Order

Stop-loss order is an order placed to buy or sell a specific forex pair once it reaches a certain price. Traders widely use it to limit a loss and control risk levels. It is a simple tool which prevents excessive losses and offers great protection.

Trailing Stop

A trailing stop is a method to protect profits by enabling a trade to remain open as long as the price is moving as the trader expected. If a trader sets a 5% trailing stop to a long position, the position will remain open until the price drops 5% from its peak price. It is more flexible compare tp stop-loss order as it tracks the price direction and does not have to reset manually.

Trading Strategy

Forex trading strategy is a system that a trader uses to buy or sell a currency pair. The strategies are majorly based on technical and fundamental analysis. It enables traders to analyse and execute trades with risk management techniques.

Day Trading

Day trading is a strategy to trade a forex pair within a day. As the positions are closed before the market close, it enables a trader to control its risk. It can be a matter of hours or even minutes, enabling a trader to execute multiple trades using technical analysis.

Swing Trading

Swing trading refers to a trading style to hold a trade for several days to weeks. It is best suitable for the patient trader who does not mind the volatility of the market. Swing trading enables a trader to earn a big chunk of profits if the price moves in the trader’s favour.

Trend Trading

Trend trading is a widely used forex trading strategy by lots of traders worldwide. It is a strategy to gain profits based on the market directional momentum. The length of trading may vary depending on the indicator and timeframe analysis.

Scalp Trading

Scalping is a strategy to trade within seconds to minutes, trading frequently to accumulate small profits which can be done manually or by the automated trading bot. Scalpers make an enormous amount of trades to take advantage of small price movements of a currency pair.

Position Trading

Position trading is a long-term trading strategy that is executed based on fundamental analysis. Technical analysis could be used to enter and exit the position. It is a method to hold a position for months or even years, focusing on the economic factors of currency pairs.

Range Trading

Range trading is to set the support and resistance price level to place orders around these prices. This strategy works when there are no large volatility and trend within the market. The length varies on the timeframe a trader is in favour of.

Carry Trading

Carry trading strategy is to borrow or sell a currency with a lower interest rate and buy another currency with a higher interest rate to earn the profit from interest rate difference. In addition to trading profit, you can also earn an interest rate. But, it carries huge risk due to the volatility of the exchange rate, which is hard to predict.

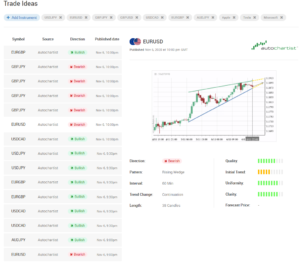

Signals and Alerts for Trading

A trading signal is a notification or alerts which offer traders an advantage to enter or exit the position on a currency pair. It can in the form of SMS, E-mail, Direct Messages or even pop-ups depending on which service a trader is using.

The alerts are mostly occurred based on technical indicators or chart patterns like 5 SMA crosses 20 SMA, giving golden-cross signals. It will be beneficial if you find a legit and fruitful signal service with fully backtested indicators to gain profits.

Other than trading signals, there are also price alerts, news alerts, economic alerts that can further help a trader to understand what is happening around the world. These alerts are mostly provided by forex brokers and trading platforms for free!

Forex Trading Platforms

MetaTrader4

MetaTrader 4 is a stand-alone online trading platform developed by MetaQuotes Software. It provides access to a range of markets and hundreds of different financial instruments, and you will have all the tools you need to manage your trades and analyze the markets.

MetaTrader5

MetaTrader 5 is the newest and most advanced online trading platform in the industry. It includes a multi-threaded strategy tester, fund transfer between accounts, and alerts to remind you of the latest events.

cTrader

cTrader is a brand-new trading platform that was established in 2010 by Spotware. It offers complete solutions for traders packed up with various features to enhance every aspect of your investment. It provides excellent indicators, advanced order types, fast entry, and execution. The User Interface is stunningly impressive and easy to understand the components.

TradingView

TradingView is a trading platform that offers advanced charting features with a user-friendly and modern user interface used by millions of traders globally. It offers live price data for forex as well as other financial instruments like stocks, bonds, gold, commodities and cryptos. Some brokers launched their services to be able to trade directly via a trading panel of Tradingview.

Frequently Asked Questions

Can I Trade Forex with $100?

Absolutely! You start Forex trading at $100 and even less! The minimum deposit requirements vary on the account type you open in forex brokers. It can be as little as only $10 or high as $1000.

Can I Become Rich from Forex?

This is purely depending on your level of trading. Any financial instruments like stocks, bonds and crypto can make you rich if you have a great trading skill with clear strategies and rules.

Can I Trade as a Full-time Job?

Yes, but you have to be very careful. Gaining consistent profit in the financial market is really difficult. We do recommend you to try with a small amount of fund while working. After trading for a few years and be able to generate consistent profit, you can consider transforming to fulltime trader.

Is Forex Trading Legal?

This will depend on the jurisdiction you belong to. It is legal in most of the countries around the globe. Before you register for an account, check the legal status of forex trading in your nation.

Is Forex Trading a Gamble?

It can become gambling if you do not aware of what you are doing. Make sure you have studied the basics of economics and have your own trading strategy before you trade with your own fund. Practising with a demo account is also a great idea.