What is Crypto?

A cryptocurrency is a digital currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers. A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation.

It was first started in 2008 when the financial depression occurred. An anonymous developer Satoshi Nakamoto (we do not know whether it is an individual or a group of people) revealed the whitepaper of Bitcoin. The purpose of Bitcoin is to replace the fiat currency that is backed by nothing but the trust of people.

Bitcoin uses blockchain technology which is also widely known as trust-protocol. There is no central bank controlling the supply of the bitcoin, but the decentralised network and nodes spread all around the world.

Why Should We Trade Crypto?

PRO

Scarcity and Limited Supply.

Bitcoin is mined all around the world by graphic cards and specialized equipment using POW(Proof-of-Work) mechanism. It has a total of 21millon coins to be issued and until today around 16million are mined.

Due to its scarcity and more people believing that Bitcoin is digital gold, the value of the crypto is likely to increase continuously. It has properties like durability, divisibility, transferability and store of value just like the money we use today.

Means of Diversification

Crypto is an excellent asset to include in your portfolio. It is a very new asset class which tend to goes against the value of fiat currency. It can be an alternative way to avoid inflation.

In fact, countries with an unstable economic system like Venusuala prefer to trade goods and services with Bitcoin rather than local currencies due to hyperinflation.

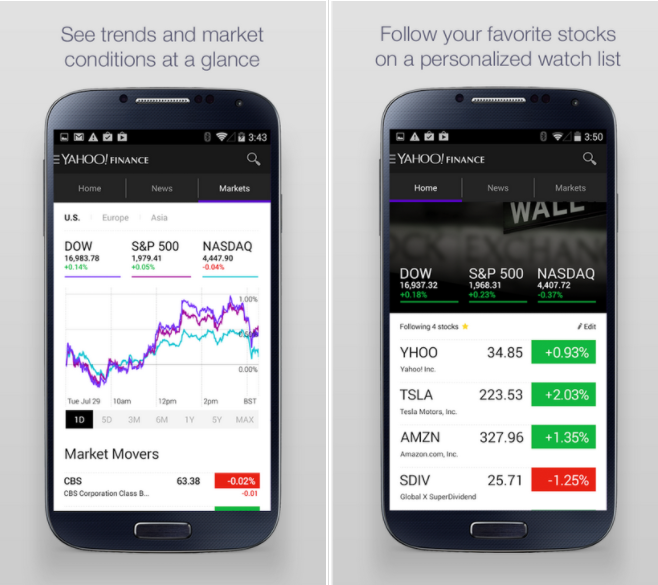

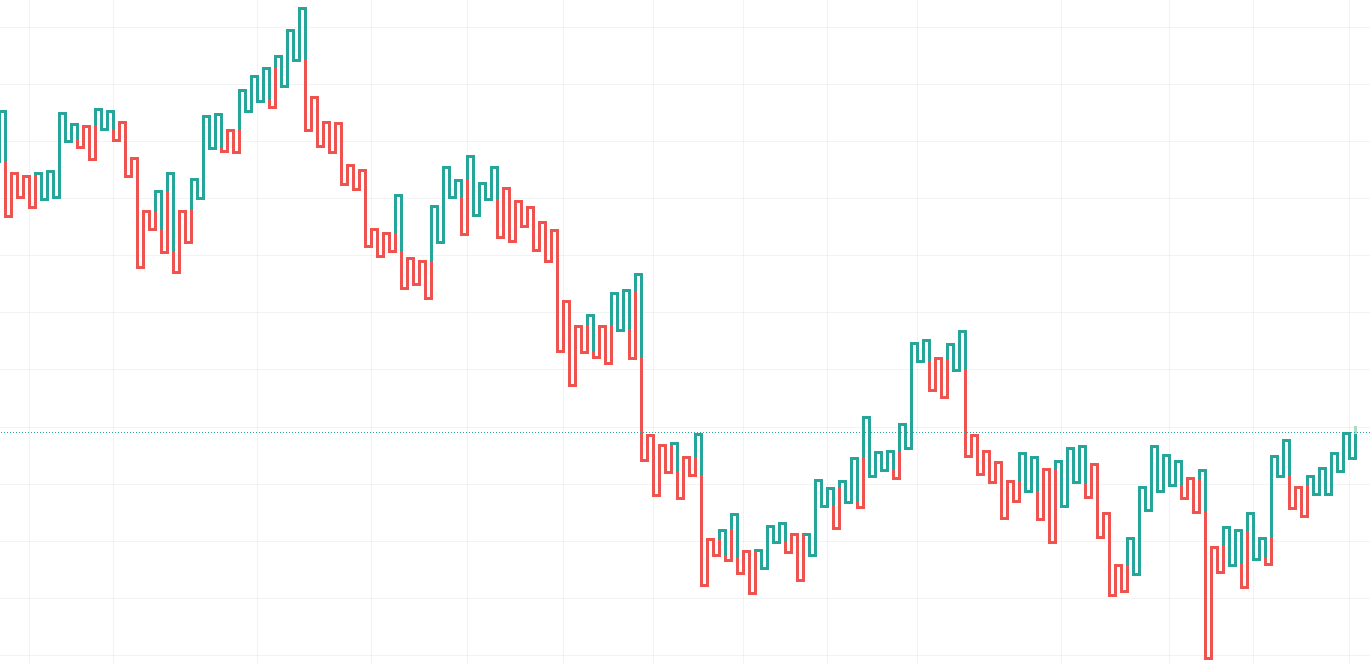

Very volatile

Volatility can be defined as a risk. But, for traders, it means opportunity. When a trader enters or exit position, the high volatility offers an opportunity to cover-up the trading cost and spread while making a profit.

Able to trade 24/7

You can trade cryptocurrency 24hours a day—365days a year. There is no centralised marketplace that opens and closes at a certain time. Therefore, you can trade whenever you want. This also implies there are more opportunities to enter positions and gain profit.

CON

Taxation

Developed countries have already started to levy taxation on the earnings on crypto. Taxation directly influence the profit you are taking.

KYC & AML Procedures

Due to website like silk way (a dark-web drug-dealing website), it has been a hot issue that crypto can be used in the dark market. Therefore, many exchanges compulsorily ask traders to do KYC(Know Your Customer) and AML(Anti Money Laundry).

Too many SCAM Coins

There have been so many coins that have been doing ICO (initial coin offering) a runaway with billions of dollars like Bitconnect and PlusToken. Therefore, the alt(alternative) coin could be risky in terms of investment. We recommend you to trade top 10 coins with enough liquidity and fundamentals.

| PRO |

CON |

- Scarcity – Bitcoin has a limited supply of 21million, which makes it very lucrative to people.

- It is a very new asset class and a great way to diversify your portfolio.

- The market is very volatile, This can be a disadvantage, but for traders, it is an opportunity.

- It is available 24hours, 7days a week, offering more opportunity.

|

- Many countries start to levy harsh taxes on cryptocurrency.

- KYC & AML procedures are required.

- Watch out SCAM and SHIT coins!

|

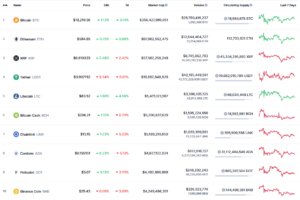

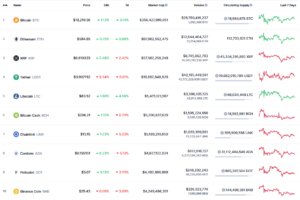

What to Trade in Crypto?

There are thousands of coins you can trade. Coins other than bitcoin is called an altcoin. We recommend you to trade top 10 coins with enough liquidity and fundamentals. Nowadays, Bitcoin and Ethereum dominate almost 70% of the entire market.

When Can We Trade Crypto?

You can trade cryptocurrency 24/7.

Cryptocurrency operates on a blockchain network. It never stops unless there are no nodes of the network worldwide or got hacked by 51% attack, cryptocurrency is always available.

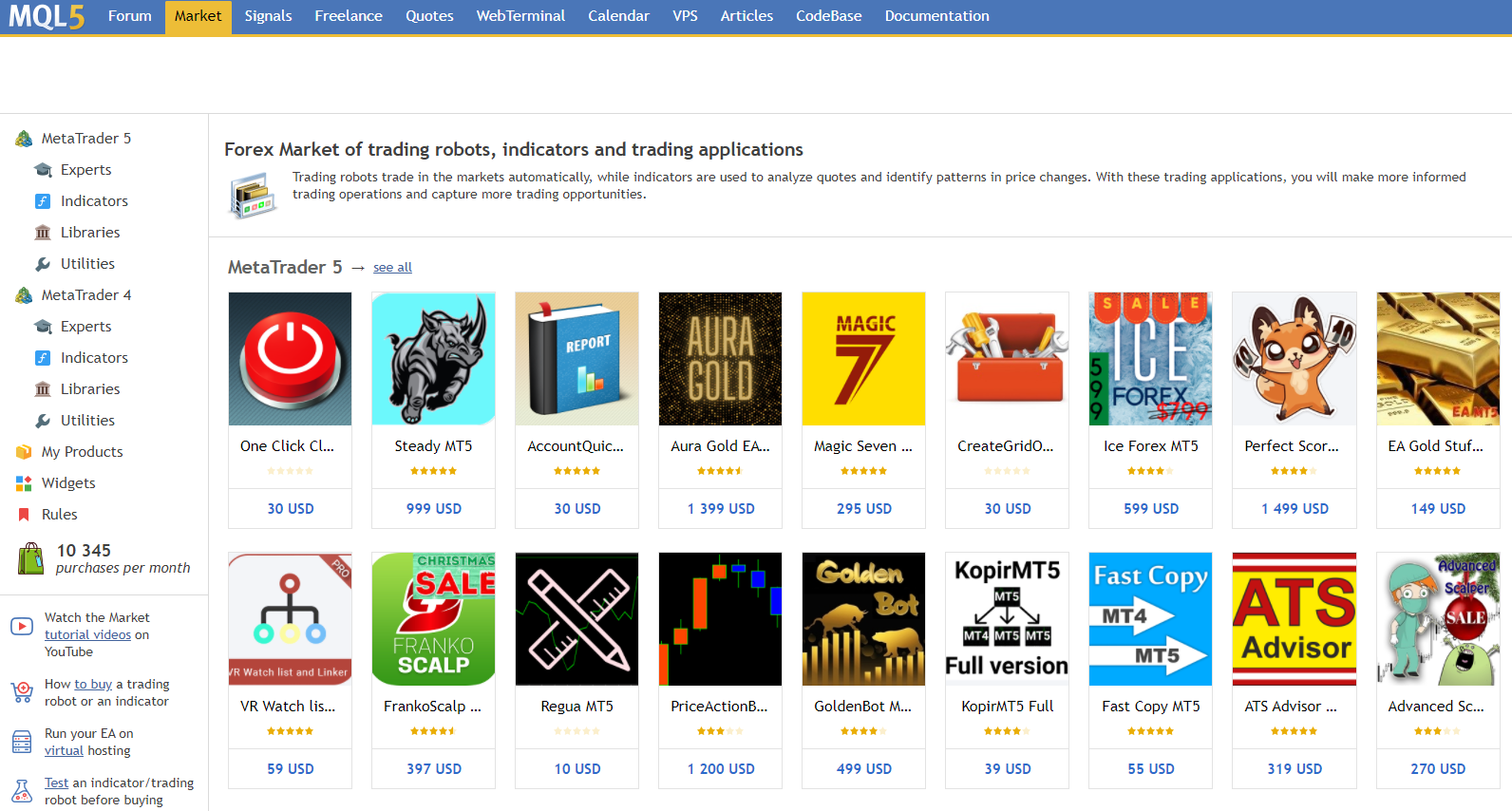

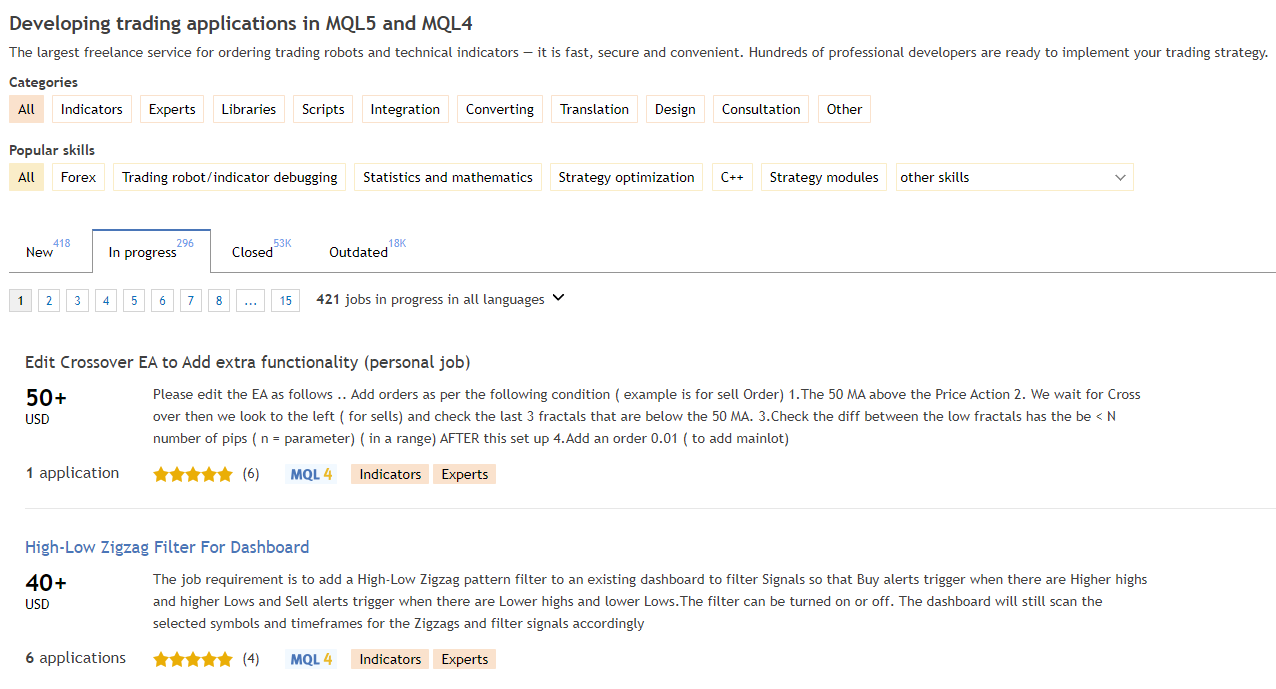

This offers traders more trading opportunity. However, you may not be able to sleep well because of this characteristic. Therefore, we recommend you to use a trading bot for your healthcare.

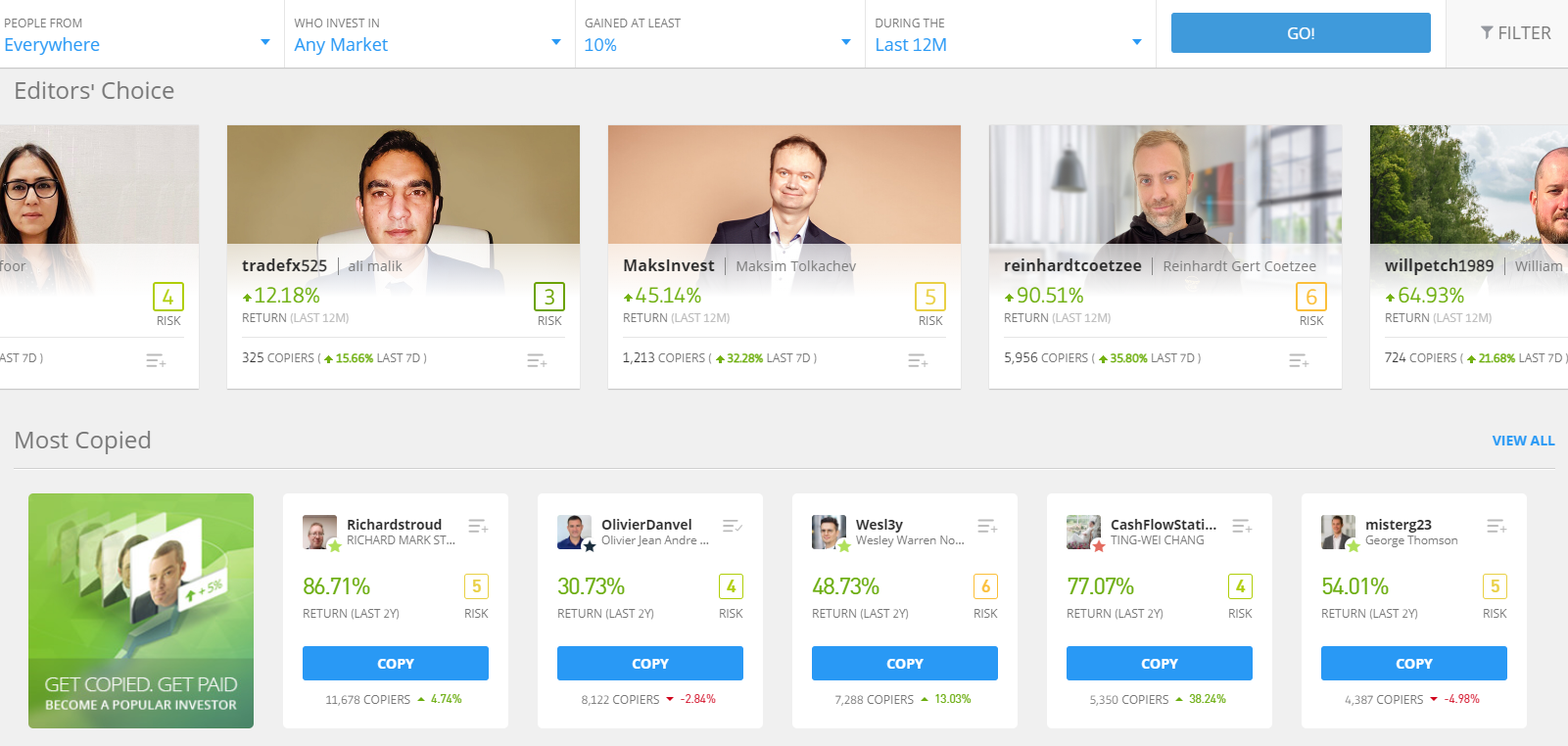

Who is Trading in the Crypto market?

Most of the market participants of the cryptocurrency market are retail investors. This is the only market that the retail investors occupied earlier than institutions.

In the early days, those people who were tech-savvy and aware of this technology mined Bitcoin using their private computer. Today, mining is tough unless you have the proper equipment with powerful graphic cards.

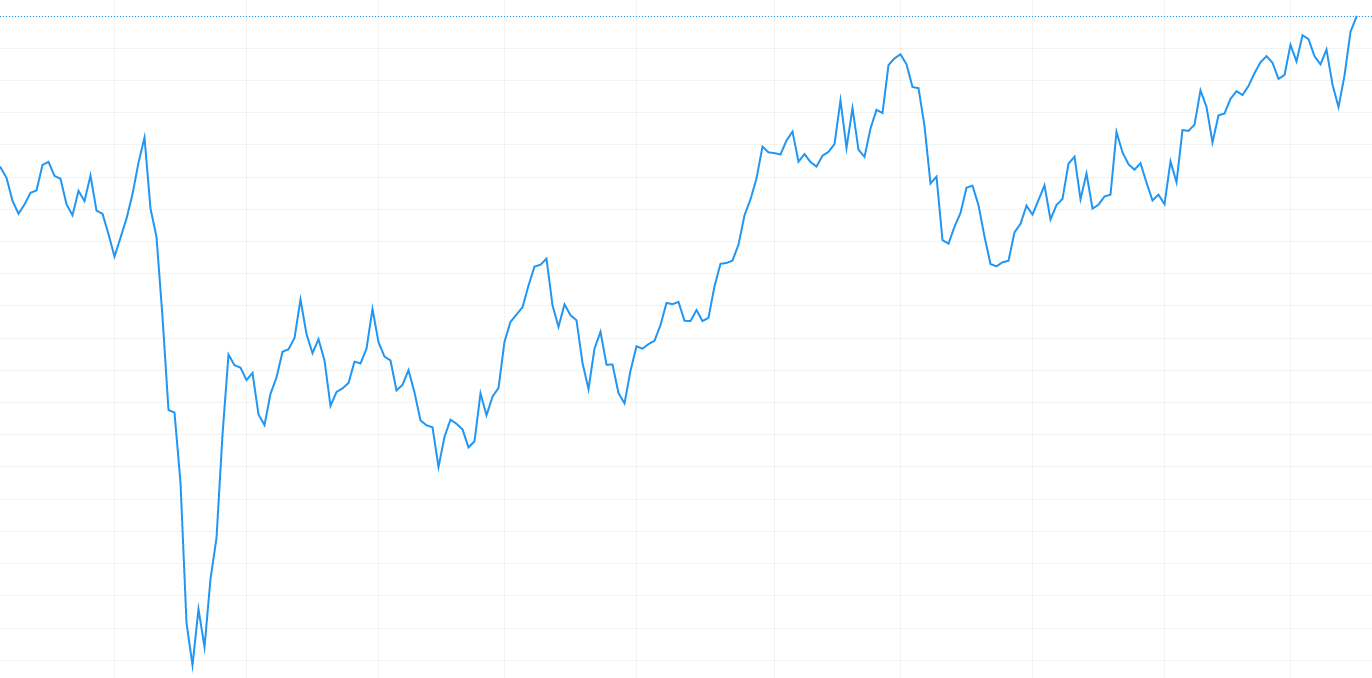

Nowadays, institutional money is coming into the market. CME Bitcoin futures was approved in December 2017. It was when the Bitcoin was all-time-high, almost $20,000 each. And the price dropped almost -85% until mid-2019. By 2020, institutions and corporations are interested in crypto and commenced to participate in the market.

More people are believing that Bitcoin is digital gold. It has shown the capability to hedge inflation and avoid depreciation of fiat currency due to the monetary policy of the Federal Reserve. FED has been printing a flood of money since the financial crisis in 2009 and pandemic in 2020. This provoked the value of the dollar to decrease contiunosly.

How to Trade Crypto?

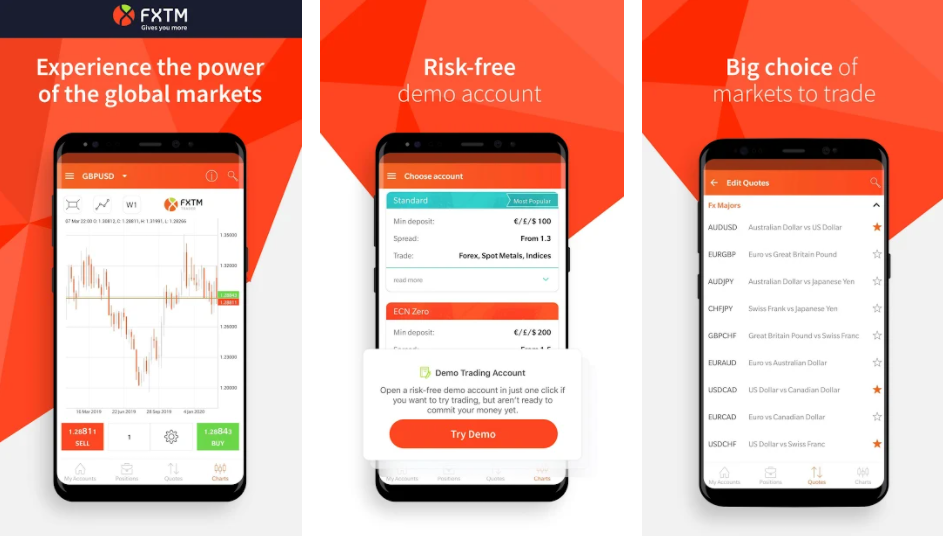

1.Choose a broker you want to use.

- Centralised Exchange

- Decentralised Exchange

- CFD Brokers

are the option you can choose.

2. Create a trading account

- For a cryptocurrency exchange, all you need is to use your email to register an account.

- If you want to increase the amount of fund to withdraw, KYC(Know-Your-Customer) is necessary.

- In terms of CFD brokers, you can determine which account type you would like to use base on the size of your fund.

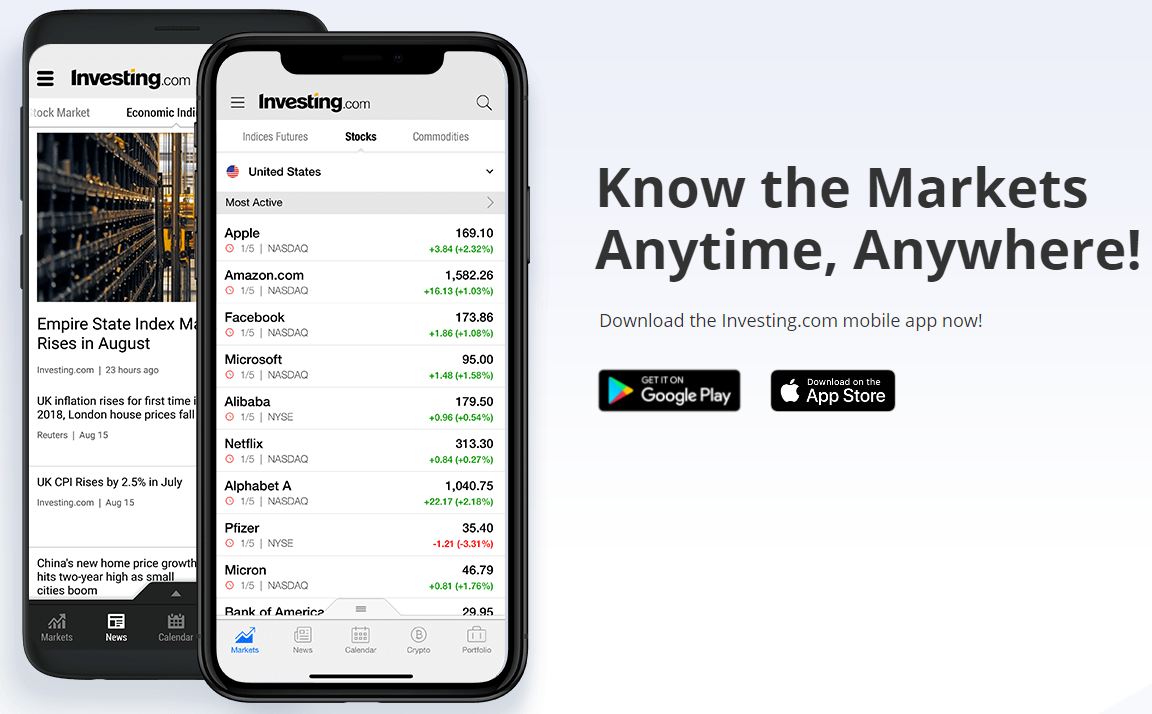

3. Choose a cryptocurrency you want to trade.

- There are thousands of cryptocurrency on the market.

- At most, 1,000 or more kinds of coins can trade on exchanges.

- Bitcoin and Ethereum are the two major cryptos that take almost 70% of the market capitalization.

- We recommend you to trade Top5 coins like Bitcoin, Ethereum, Ripple Litecoin and Dash with enough liquidity and validity.

4. Start your crypto trading journey!

- After choosing crypto, you can start trading in various method.

- You can choose a Spot(No Leverage), Futures(Has Leverage) and CFDs(For CFD Brokers)

- Make sure you understand the characteristic of the market and prepare a strategy before opening a position!

How is Crypto Traded?

Centralised Exchange

If you are trading in cryptocurrencies like Binance, the counterparty is other market participants. Buying crypto at a certain price means somebody has placed an order to sell at the given price. Selling crypto means somebody has put order to buy the crypto that you sold! Pretty simple right?

Decentralised Exchange

Decentralised Exchange is the exchanges where you have to connect a cryptocurrency wallet like Metamask to the platform. It is also named DEX (Decentralised Exchange), and the examples are like Banco and Kyber Network.

The difference between centralised and decentralised exchange is that DEX does not have the authority to control your fund as it is in your own wallet. Instead, it offers an escrow service, a wallet to wallet transaction, that helps you to find another person exchange.

OTC (Over-the-Counter)

OTC is a way to get cryptocurrency directly from fiat currency to cryptocurrency. Big centralised exchanges like Huobi and Binance do offer OTC service for those people with the larger fund.

The purpose of the OTC is that if a person wants to buy 1million dollar worth of BItcoin, the probability that the person will not be able to buy at the price he or she wants due to limited liquidity.

Therefore, the person can request these middle man to say I want 1 million USD worth of Bitcoin at the price of 20,000 USD with a fee of 0.2% fixed.

P2P (Peer to Peer)

P2P is a peer to peer transaction which you exchange crypto to fiat currency from another person directly.

Again, Binance, Huobi and other large centralised exchanges offer P2P service to exchange with other users. The major reason why P2P is popular is that the Chinese government has banned CNY (Chinese Yuan) to purchase crypto through a crypto exchange in September 2017.

Thus, Chinese people use CNY to exchange USDT through P2P exchange and use USDT to trade cryptocurrency.

CFD Brokers

CFD brokers also offer cryptocurrency as a trading instrument. Since CFD(Contract for Difference) is a derivative financial product, it is only tracking the underlying asset.

Therefore, you are not owning a cryptocurrency but trading only with the price. Often time the counterparty is the CFD broker which offers you the liquidity.

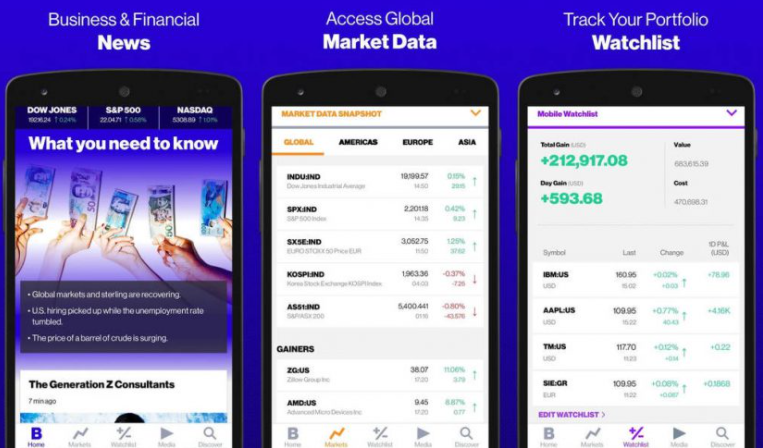

Where Can I Learn About Crypto Trading?

Books: There are not much of books for crypto compare to other traditional financial assets since it is very new. But, many books are handling the basics of blockchain technology and visions of cryptocurrency,

Youtube: There are many fake gurus on Youtube. Choosing the right youtube will be important.

Whitepapers: If you want to invest crypto in a fundamental approach, go through the whitepaper of each coin. It will give you a better understanding of the coin you want to trade or invest. This may require you to have a base knowledge of blockchain technology.

Twitter: Twitter is a great way to track the movement of the market. The founder of Ethereum Vitalik Buterin, Charlee Lee of Litecoin and others upload a Twitter message regularly to keep in touch with people.

Trading Strategies

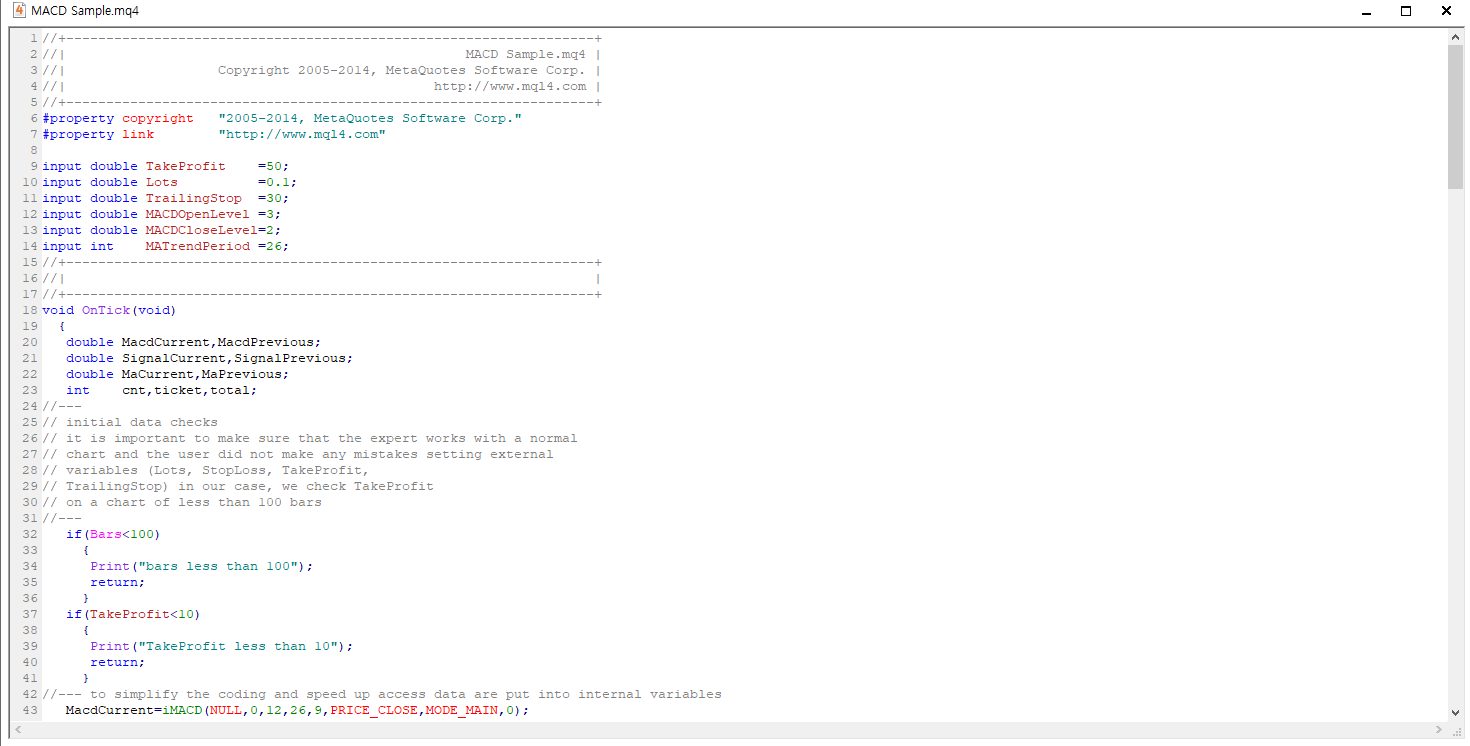

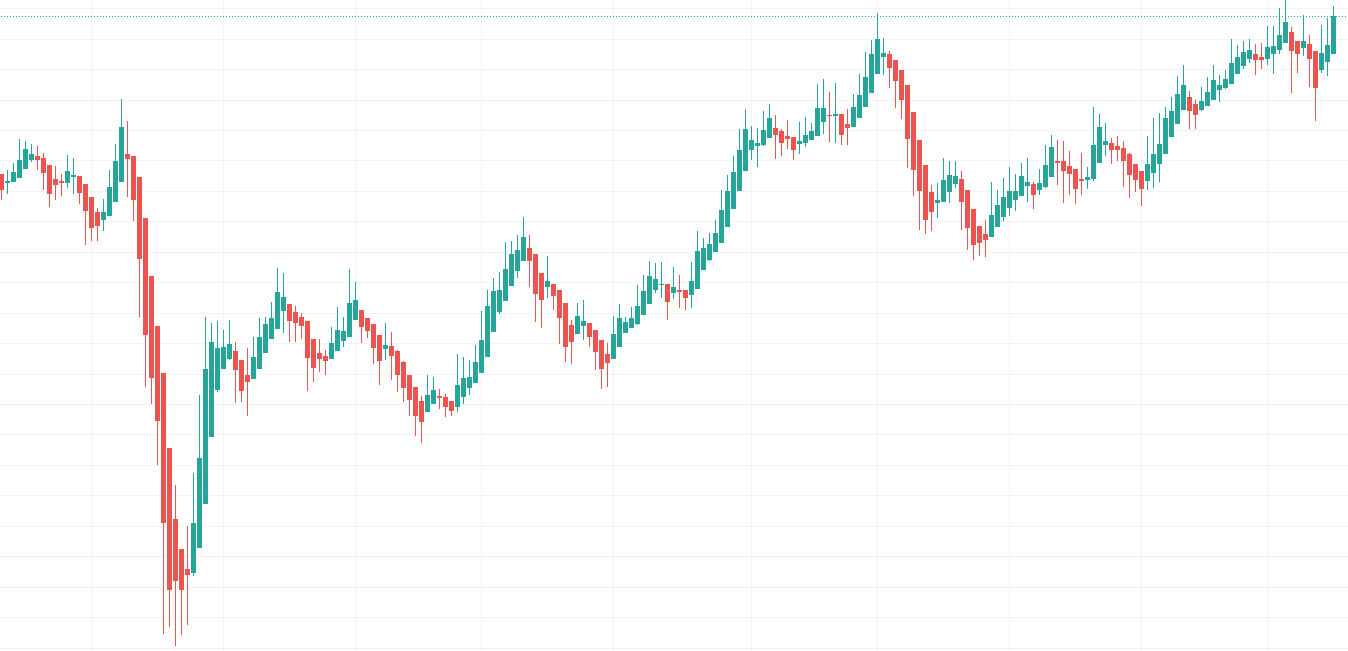

Volatility Breakthrough Strategy

Volatility Break-out Strategy was developed by Larry Williams, who is a legendary trader and author of many trading books. This strategy is suitable for trading indices, commodities and crypto. The formula of the strategy is

Buy = (Previous High-Previous Low)*K + Open Price

- When the price breaks through the level of buying condition, enter the position.

- K can vary from 0.5 ~ 1.0.

- It is based on short-term momentum.

Sell = When a candle closes (Time-cut)

- This strategy uses a special means of pending order method named Time-Cut.

- You are selling when a certain time arrives.

- This is based on intraday anomaly and means regression.

This is the strategy that we use for trading Bitcoin. Over the 3 years, it recorded 530% of total profit with Maximum Draw Down of -15%!

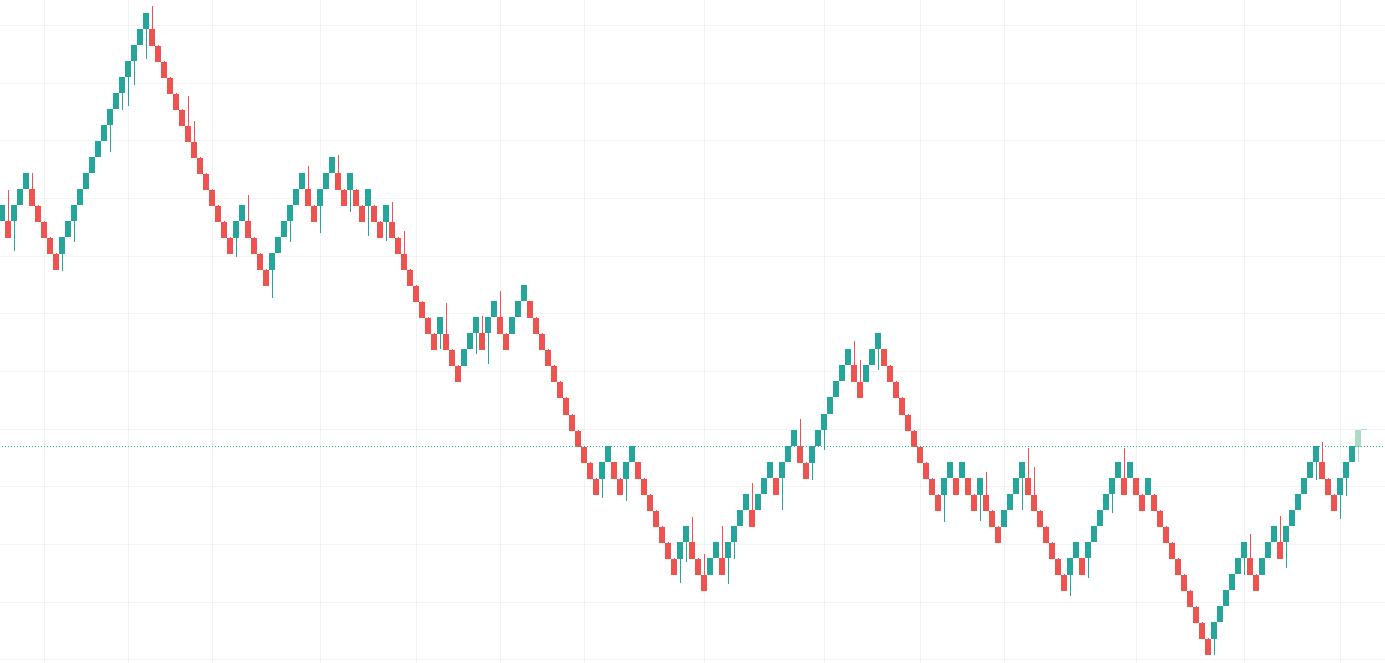

Arbitrage

As cryptocurrency does not have a centralised exchange, we can see the price difference among exchanges frequently. During the end of 2017 and early 2018, we were able to see a 25%~30% price difference from Korean crypto exchange to the other exchanges. This is called Kimchi-Premium, and people were able to make lots of money with the price gap.

Today, the gap between the exchanges are not the big as previous years as more market participants are using an algorithm to arbitrage them. This enabled exchanges to have almost the same market price. But, there are still chances you can gain profit from the price difference if we observe them.

Frequently Asked Questions

Can I become rich trading Bitcoin?

Yes, you can.

But, you have to stay really focused! The market runs 24/7, so it would be better to use trading bot. Or you can buy and hold until it goes $100,000 and HODL the volatile market!

Should I trade cryptocurrency?

It is your choice, but cryptocurrency is definitely a brand-new asset class with volatility and momentum that operates 24/7. It might be too volatile to buy and hold, but an opportunity for trading perspective. You can also choose to invest 1~5% of your portfolio to increase the profit rate while managing the risk.

Can I trust Bitcoin?

You do not have to trust Bitcoin. It is just an asset for you to trade as a trader. The more important thing is to choose the right crypto exchange or CFD brokers!